Introduction to the Crypto Fear and Greed Index

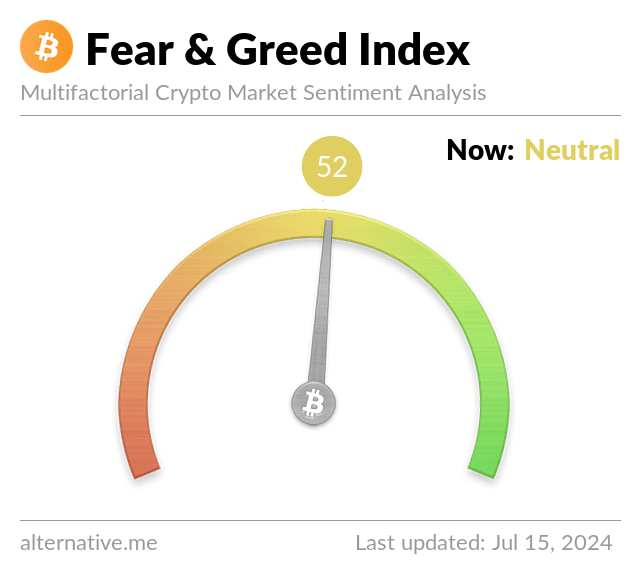

In the dynamic world of cryptocurrency, the Fear and Greed Index is a crucial indicator that helps investors gauge the market’s emotional temperature. As of recently, this index has risen to 52, transitioning from a state of fear to a more balanced sentiment. Understanding why this significant shift has occurred can provide investors with insights into the current market dynamics and potential future movements.

What is the Fear and Greed Index?

The Fear and Greed Index for cryptocurrencies is a tool that measures the primary emotions influencing market participants’ activity and decisions. It operates on a scale from 0 to 100, where lower values represent “fear,” which indicates a possible undervaluation, and higher values indicate “greed,” which suggests an overvaluation. At a value of 52, the market sentiment is neutral, leaning towards slight optimism.

Factors Contributing to the Rise in the Index

The recent increase to 52 in the index can be attributed to several key factors:

- Market Recovery: After periods of bearish trends, positive corrections or recoverer may encourage investors, thus pushing the index higher.

- Improved Economic Indicators: Global economic stabilization or growth can lead to increased investment in cryptocurrencies, reflecting a greater appetite for risk.

- Technological Advances: Innovations within the blockchain environment, such as scalability improvements or new protocols, can boost investor confidence and drive market sentiment.

- Regulatory Clarity: Clear regulations and policies from leading economies regarding cryptocurrency usage and trading significantly impact investor sentiment in a positive manner.

Implications of a Neutral to Positive Index Value

As the index approaches a level of 52, it indicates bearish sentiment is subsiding, and bullish sentiment begins to take hold, but with caution. This neutral to optimistic attitude may hint at the following:

- Stability: Investors might perceive the market as stabilizing, which could lead to more strategic and long-term investments in crypto.

- Growth Opportunities: A neutral or slightly greedy index level might signal budding growth opportunities, prompting both retail and institutional investors to partake more significantly in the market.

- Market Expansion: As more investors feel confident about the conditions, new capital may flow into the market, leading to expansion and more robust market infrastructure.

Future Outlook and Investor Considerations

While the rise in the Fear and Greedy Index is a positive signal, investors should remain cautious and informed. It’s vital to consider not only market indicators like this index but also broader economic factors, technological advancements, and regulatory changes. Investments should be made based on thorough research and a balanced perspective of the market’s potential risks and rewards.

Conclusion

The increase in the crypto Fear and Greed Index to 52 is an interesting development indicating a shift in market sentiment. Investors, both new entrants and seasoned players, should monitor this trend closely while crafting a strategy that aligns with their financial goals and risk tolerance. Remember, the crypto market is volatile, and while the index offers valuable insights, it is just one of many tools investors can use to understand and navigate the market.

For those looking to invest, now might be a prudent time to reassess your portfolio and consider how these changes in market sentiment might impact your investment decisions. As always, stay updated, stay educated, and consider diversifying your investments to manage risk effectively.