Key Takeaways

- Fidelity’s Wise Origin Bitcoin Fund saw the largest outflow with $374 million leaving in the seven trading days.

- BlackRock’s iShares Bitcoin Trust experienced its second-ever outflow since its inception in January.

Share this article

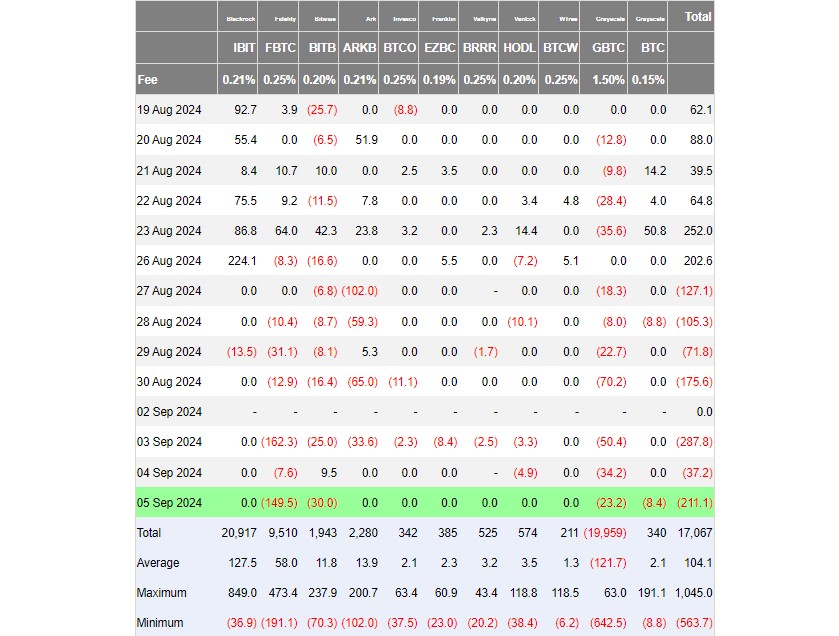

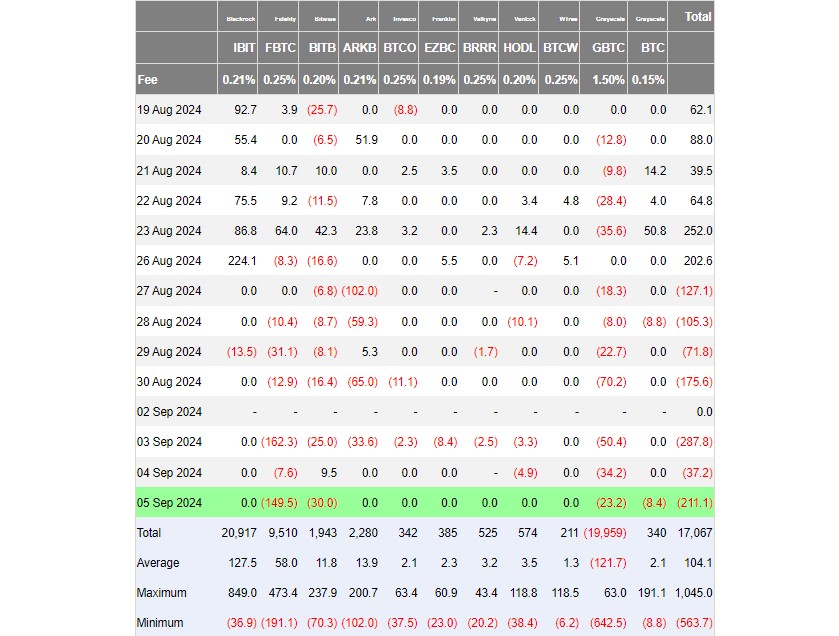

US spot Bitcoin exchange-traded funds (ETFs) endured net outflows for straight seven trading days, collectively shedding over $1 billion from August 27 to September 5, according to data from Farside Investors.

Notably, Fidelity’s Wise Origin Bitcoin Fund (FBTC) was the one that led the capital exit, not Grayscale’s Bitcoin ETF (GBTC). Approximately $374 million left FBTC over those seven days while GBTC posted $227 million in outflows.

The world’s largest Bitcoin ETF, BlackRock’s iShares Bitcoin Trust (IBIT), saw its second-ever outflow since its January launch, with investors withdrawing $13.5 million on August 29. IBIT has reported zero flows on other days during the stretch.

This marked a minor downturn from the fund’s previous performance, as it had seen consistent inflows in the weeks leading up to the stagnation.

Other US Bitcoin ETFs, except for WisdomTree’s Bitcoin Fund (BTCW), similarly reported losses, with no significant capital inflows during the period.

Bitcoin’s reversal is challenged amid ETF outflows and market fears

Bitcoin’s (BTC) recent price decline has been exacerbated by persistent ETF outflows and growing global market uncertainty. Thursday saw a major net outflow of $211 million from US Bitcoin funds, marking the fourth-highest daily outflow since May 1.

Bitcoin’s price has been unable to break above the $65,000 resistance level, leading to continued selling pressure. While long-term Bitcoin investors remain profitable, short-term holders are facing challenges in the current market conditions.

The fear and greed index remains firmly in the fear territory, reflecting broader market concerns about a potential recession.

Bitcoin’s price has dropped by over 4% in the past week, currently trading around $56,500, per TradingView’s data.

Share this article

This news is republished from another source. You can check the original article here