Unity Software Inc.: Navigating Change and Embracing the Metaverse

In a world increasingly captivated by the promise of the metaverse, Unity Software Inc., renowned for its 3D development platform, is strategically transitioning to become a key player in this virtual reality. Despite recent financial hiccups, Unity’s metaverse trajectory appears promising, boosted by the strategic acquisition of cloud gaming and streaming firm, Parsec. However, Unity’s strategic shifts, management transitions, and financial performance have drawn the watchful eyes of Wall Street.

Embracing Change and Innovation

Unity showcased its commitment to innovation and developer support at the recent Unite 2023 developer conference, unveiling new products like Unity 6, Unity Muse, and Unity Cloud. This commitment to growth and change extends to the company’s management as well. Jim Whitehurst has been appointed as the interim CEO, stepping into a role of great responsibility and uncertainty. Unity is also aiming to become leaner, shedding unprofitable segments and reducing headcount, with a restructuring expected to conclude by early 2024.

Competitive Landscape and Financial Health

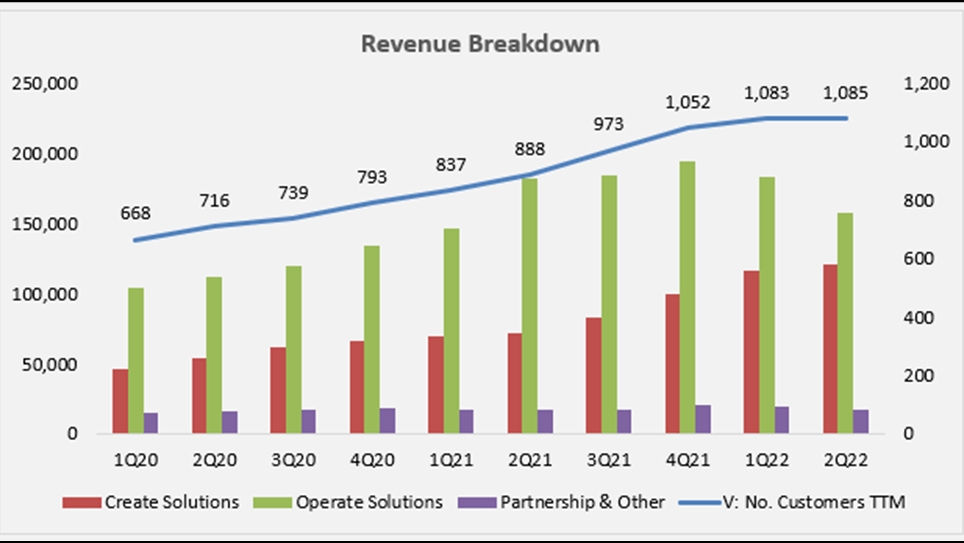

Unity operates in a highly competitive market, with rivals like Epic Games, Adobe, and Autodesk. This competition, coupled with the lack of financial guidance and ongoing restructuring, has raised concerns over its growth and margin outlook. However, Unity’s gaming engine remains a market leader with significant growth potential. Currently, the company’s market capitalization stands at 14.08 billion, and its aggressive share buyback program and revenue growth signal a transformation with significant growth potential, albeit tempered by current profitability challenges.

Looking Ahead

Unity has been expanding into emerging technologies with AI-powered and AR tools, enhancing its offerings beyond its traditional gaming market. Its acquisition of ironSource has bolstered its advertising capabilities, indicating a commitment to diversification. Despite the suspension of financial guidance and lowered revenue estimates due to strategic and execution risks, analysts recognize Unity’s potential for recovery. They cite its market leadership, new pricing strategies, and the integration of ironSource’s capabilities as opportunities for growth.

This news is republished from another source. You can check the original article here