- BTC sent to exchanges over the past week was worth over $1 billion

- At the time of writing, the crypto had recovered somewhat after dipping under $55,000

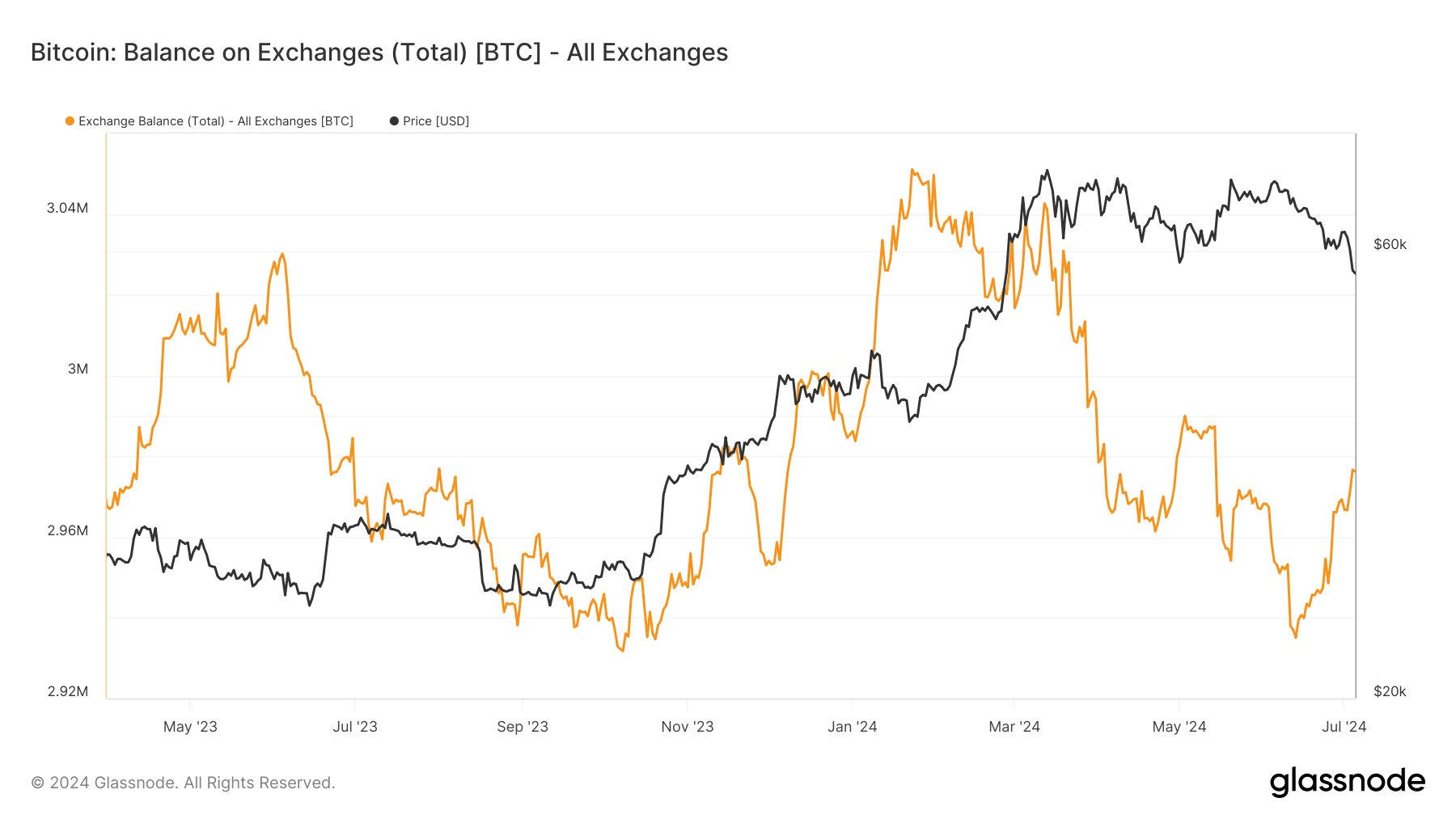

There has been a notable influx of Bitcoin to exchanges recently. This has coincided with a challenging period for the world’s largest cryptocurrency, with it being one of BTC’s most significant downturns in recent months. Needless to say, this has had an impact on the crypto’s holders, including whales.

In fact, a BTC whale that was inactive for over ten years has now transferred all of its holdings.

Billions of dollars of BTC hits exchanges

Recent data from Glassnode highlighted a significant increase in the volume of Bitcoin being transferred to exchanges.

AMBCrypto’s analysis of this data revealed that between 1-5 July, more than 9,500 BTC, valued at approximately $540 million based on current prices, moved into exchanges.

Expanding the timeframe to the past week revealed an even larger transfer, with over 21,000 BTC moved — Equivalent to more than $1 billion in value. This surge in exchange inflows could indicate a preparation for selling, potentially putting downward pressure on Bitcoin prices in the short term.

Decade-old Bitcoin wallet reawakens

That’s not all, with Lookonchain detecting a significant action involving a wallet that had been dormant for over a decade.

This wallet recently transferred all of its contents, totaling 1,004.5 BTC. The analysis indicated that these coins were acquired in 2014 at an average price of $735 each, valuing the total holdings at approximately $738,000 at the time of acquisition. Given the current market price of Bitcoin, these coins are now valued at around $57 million.

This substantial increase in value highlights the significant appreciation of BTC over the years. Also, it highlighted the potential impact such large, unexpected transactions could have on market dynamics.

More BTC movements

This week, several significant Bitcoin transactions have occurred that are influencing market dynamics. Mt. Gox conducted a test transaction involving over 1,000 BTCs as part of their preparation for planned payouts to creditors.

In addition to this, the defunct exchange moved more than 42,000 BTC, valued at over $2 billion, from wallets that had been inactive for over a decade.

Additionally, the German government has also moved over 4,000 BTC to exchanges. These large-scale movements from significant and previously dormant holders have contributed to increase liquidity on the sell side of the market.

Furthermore, such activities can lead to heightened sell-side pressure. This can impact its price by driving it south due to the sudden hike in available supply on the market.

Bitcoin struggles to rebound

According to AMBCrypto’s analysis of Bitcoin on the daily time frame, BTC seemed to be still struggling to stabilize amid its ongoing decline. The same was highlighted by the positioning of its RSI and Moving Averages.

– Read Bitcoin (BTC) Price Prediction 2024-25

At the time of writing, the cryptocurrency was trading at around $56,600, fluctuating between minor gains and losses.

This news is republished from another source. You can check the original article here