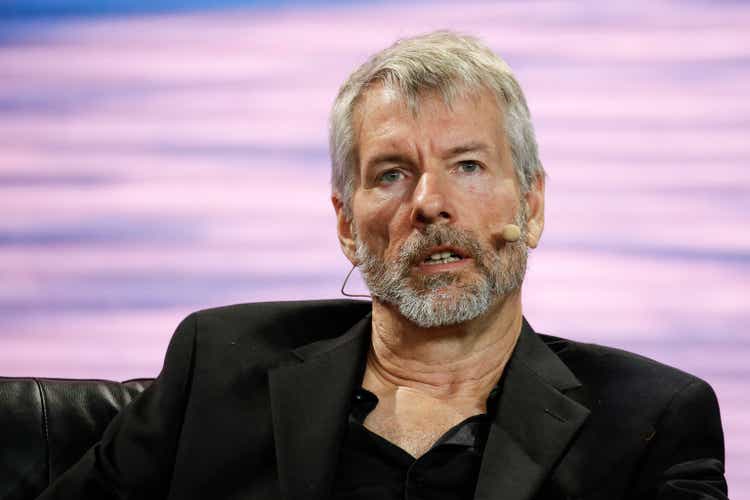

Marco Bello/Getty Images News

Cantor Fitzgerald started coverage on shares of MicroStrategy (NASDAQ:MSTR), the world’s largest corporate owner of bitcoin (BTC-USD), with an Overweight rating on Wednesday on the view that “demand for bitcoin will meaningfully accelerate from here.”

At the end of Q2, Michael Saylor-founded MicroStrategy (MSTR) held 226,331 bitcoin (BTC-USD), representing 1.1% of all the 21M bitcoin that will ever be mined.

“Unlike the dollar, which is worth more today than it is tomorrow, Cantor believes Bitcoin will be worth more in the future than it is today,” the firm wrote in a note to clients. Unlike global fiat currencies, Cantor noted, bitcoin’s (BTC-USD) annual supply increase will decline every year until the last bitcoin is mined in 2140.

On the demand side, the firm pointed to an entire ecosystem that is building on top of bitcoin (BTC-USD), as well as “institutions being under-invested and governments potentially considering adding Bitcoin into their strategic Treasury reserves.” Such demand dynamics are expected to drive up the price of bitcoin, which currently stands roughly 20% below its all-time high of $73.1K.

Cantor’s Overweight rate diverges from the SA Quant system rating and the average SA analyst rating, both at Hold, and aligns with the average Wall Street analyst rating of Strong Buy.

(MSTR) inched up 0.2% in premarket trading.

This news is republished from another source. You can check the original article here