Metaplanet Company is increasing its focus on Bitcoin investments. Japanese firm Metaplanet has raised ¥4 billion to increase Bitcoin holdings even though its stock is scheduled to enter the MSCI Japan Index. Resolutions from institutions together with their optimistic predictions indicate whether this marks the start of Bitcoin-driven market growth.

Metaplanet Secures ¥4 Billion for Bitcoin Expansion

The company Metaplanet achieved successful funding of ¥4 billion from its 0% unsecured bond release. The company dedicated all bond proceeds to Bitcoin acquisition for its future operations. Metaplanet made its bond issuance to EVO FUND to strengthen its dedication toward building up its Bitcoin reserves.

The company maintains 1,761.98 Bitcoin worth ¥27.9 billion at present. Metaplanet dedicated ¥717 million to Bitcoin acquisition starting from February 2027 until the completion of the buying period. Metaplanet intends to buy 21,000 Bitcoin before 2026 for its strategic use as a main reserve asset because of Japan’s uncertain economic situation.

Bitcoin Strategy Fueled by Economic Concerns

Metaplanet attributes Japan’s financial problems together with its large national debt along with sustained negative interest rates and decreased yen value as the main drivers for Bitcoin adoption. The firm embraces Bitcoin as a tool to protect against both inflation and currency devaluation because this belief drives its treasury policy transition.

The company intends to put §5 billion into Bitcoin-based income-generating procedures until 2025. The organization follows this investment philosophy because it supports its monetary goal of maximizing financial returns while making its business more stable during economic uncertainty.

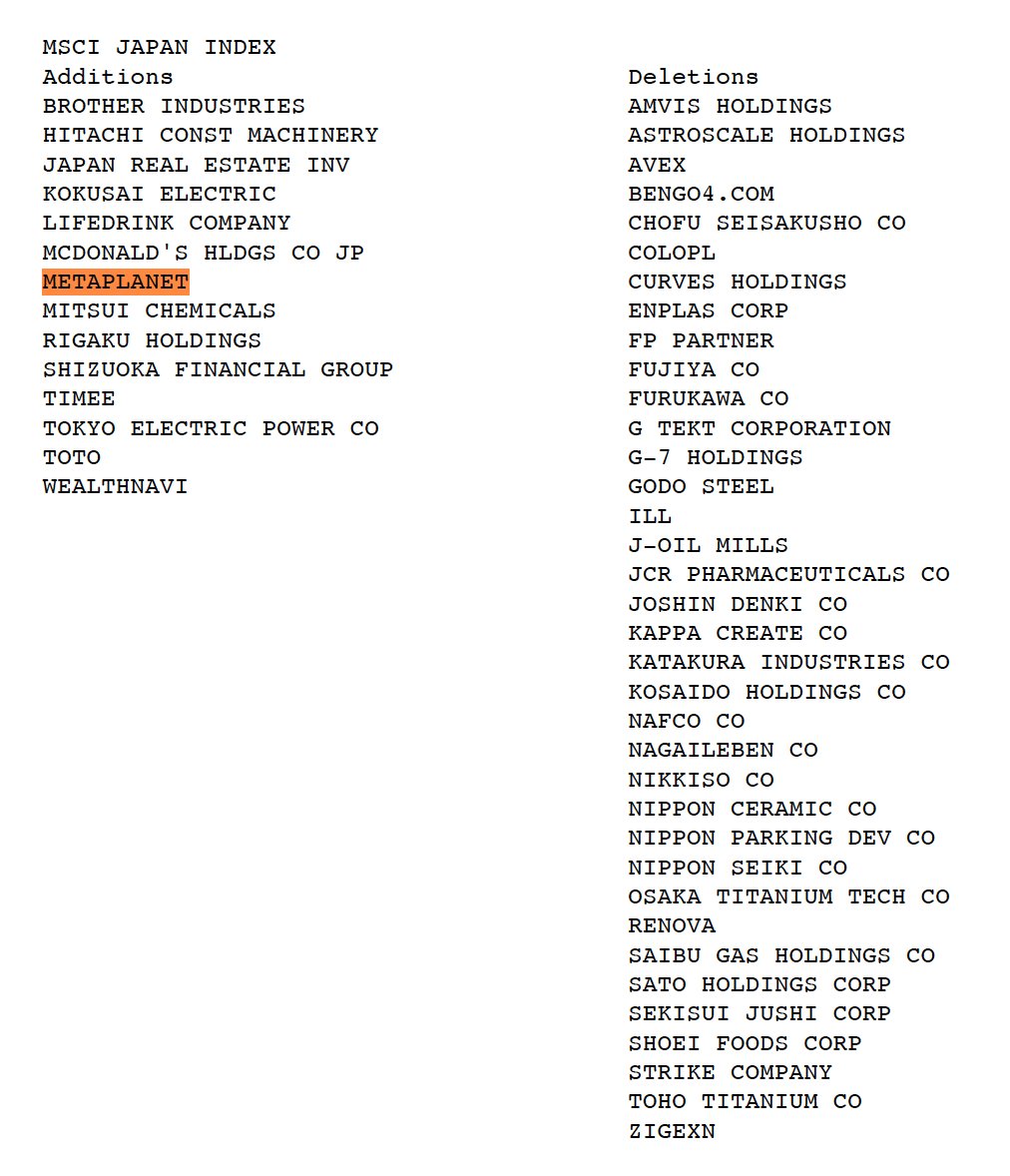

Metaplanet to Join MSCI Japan Index

Metaplanet’s CEO Simon Gerovich informed investors that their stock participation in the MSCI Japan Index will commence on February 28, 2025. This index monitors major Japanese stocks and medium-cap companies to serve as a standard for worldwide organizational investors.

The MSCI Japan Index inclusion will elevate visibility along with attracting institutional investors who seek stability and thus improve market value and liquidity. The addition of Metaplanet stock to the MSCI Japan Index could generate more stock demand following the company’s Bitcoin strategy implementation which has resulted in a 4000% increase in its stock value.

What Lies Ahead for Metaplanet and Bitcoin?

The Bitcoin accumulation strategy of Metaplanet is driving the company to establish advanced boundaries for corporate BTC acceptance. The company plans to acquire at least 10,000 BTC before the end of 2025 through bond issuances and stock acquisition rights to fund its global financial market approach.

Long-term benefits could emerge for Metaplanet because of its strategic position in the growing Bitcoin market acceptance. Metaplanet’s future development depends on the present market dynamics combined with Bitcoin cost changes about regulatory evolutions.

Metaplanet dedicates itself to building its digital assets position through Bitcoin acquisition because Bitcoin represents its preferred framework for future financial security.

Conclusion

Metaplanet takes an aggressive Bitcoin approach through economics considerations combined with market development and MSCI Japan Index compliance which creates sustainable growth for the company in Bitcoin’s changing regulatory environment and market behavior.

This news is republished from another source. You can check the original article here