Bitcoin, Ethereum, and XRP face carnage in response to Trump’s policies and announcements. The total market capitalization of crypto is down to $2.784 trillion on Wednesday.

Bitcoin’s correlation (BTC) with the S&P 500 is 0.75 in the 30-day timeframe, signaling to traders that the top crypto is behaving like U.S. equities. Trumpism, or what U.S. President Donald Trump believes in a particular moment on a particular day about a subject that has ushered a steep correction in crypto within the first fifty days of his administration.

Why is crypto losing while Trumpism wins?

U.S. stocks are facing a slump, the S&P 500 is down nearly 8% in the past month, and is lower than it was the day before President Trump won the 2024 election. $4.5 trillion in capital has been wiped out of the market, per the index, and the correction is not limited to equities.

Crypto, typically considered one of the high volatility risk assets, has faced a steep decline as traders turn risk averse and pull capital from the category.

While U.S. stock performance is among one of the worst ever recorded within the first 50 days of a new administration, crypto market capitalization is nearly 20% above the pre-election level, even after the correction.

When Bitcoin crossed the $100,000 milestone and hit a new all-time high, Ethereum and XRP rallied alongside. The market-wide bloodbath has ushered a decline in the top three cryptos, down nearly 15%, 28% and 9% in the past month, according to TradingView data.

Trump’s pro-crypto executive orders and Strategic Crypto Reserve announcement have failed to catalyze a positive sentiment among traders. Alternative.me’s Crypto Fear & Greed Index shows traders remain fearful on Wednesday.

In a February report, Forbes evaluated the impact of Donald Trump’s return to the Presidency on alternative investments like digital assets. The publication outlined that it depends on “the details of policy implementation, market expectations, and global economic conditions. While some sectors may benefit from deregulation or tax incentives, others might face reduced government support or policy shifts.”

Traders, therefore, need to proactively switch strategies and adjust portfolios, trade headline to headline, and anticipate the potential changes, such as the inclusion of different tokens in the U.S. Strategic Crypto Reserve, to prioritize categories of tokens that are likely to receive favorable treatment or have inherent resilience to policy-induced volatility.

Crypto market crash, pre and post-election performance of Bitcoin, Ethereum, XRP

The crypto market and top three tokens continued their decline this week after nearly four-consecutive weeks of correction. As crypto traders digest Trump’s tariff wars and executive orders, institutions and market participants have turned risk-averse and realized losses in Bitcoin are mounting.

BTC is now at a crossroads where financial easing could mean crypto tokens gain, as traders drive demand for risk assets higher. However geopolitical headwinds and Trumpism continue to weigh heavily on the sector.

The debate on whether a Strategic Crypto Reserve would meet the expectations of the crypto community and what the inclusion of Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA) means for holders of the token wages on social media platforms.

Traders now wait and watch for the narrative to unfold. It is typical for the Bitcoin price to drop between 20 and 25% before it rallies during a bull market. However, the macroeconomic headwinds and higher number of market movers make it challenging to predict BTC price trends in the coming weeks and months.

The $80,000 level remains a crucial support for Bitcoin; a return to the $100,000 milestone could see BTC rally towards its all-time high and test it. However, a decline from $80,000 could push the token to pre-election levels under $70,000.

Another 15% drop from the current price level could erase all post-election gains for Bitcoin.

Ethereum price is 30% below its pre-election level, back to the price recorded in November of 2023. A multitude of factors, lack of institutional interest, concerns regarding changes within the Ethereum Foundation, liquidation of whales who borrowed stablecoins against their Ether holdings as collateral, and waning interest from large wallet traders have negatively impacted Ethereum price trend.

Ether trades at $1,846 at the time of writing, and traders await a catalyst, like SEC approval, to add staking to existing Ether ETFs in the U.S. to drive gains in the largest altcoin in crypto.

XRP is the most resilient among the top three cryptocurrencies, trading 75% above its pre-election levels. At the time of writing, XRP trades at $2.1668.

Catalysts like the token’s addition to the U.S. Strategic Crypto Reserve, Ripple executive’s inclusion in Trump’s elite Crypto Summit last Friday, and SEC’s changing stance on litigation against crypto firms have contributed to the gain in XRP price.

Bitcoin, Ethereum, and XRP on-chain analysis

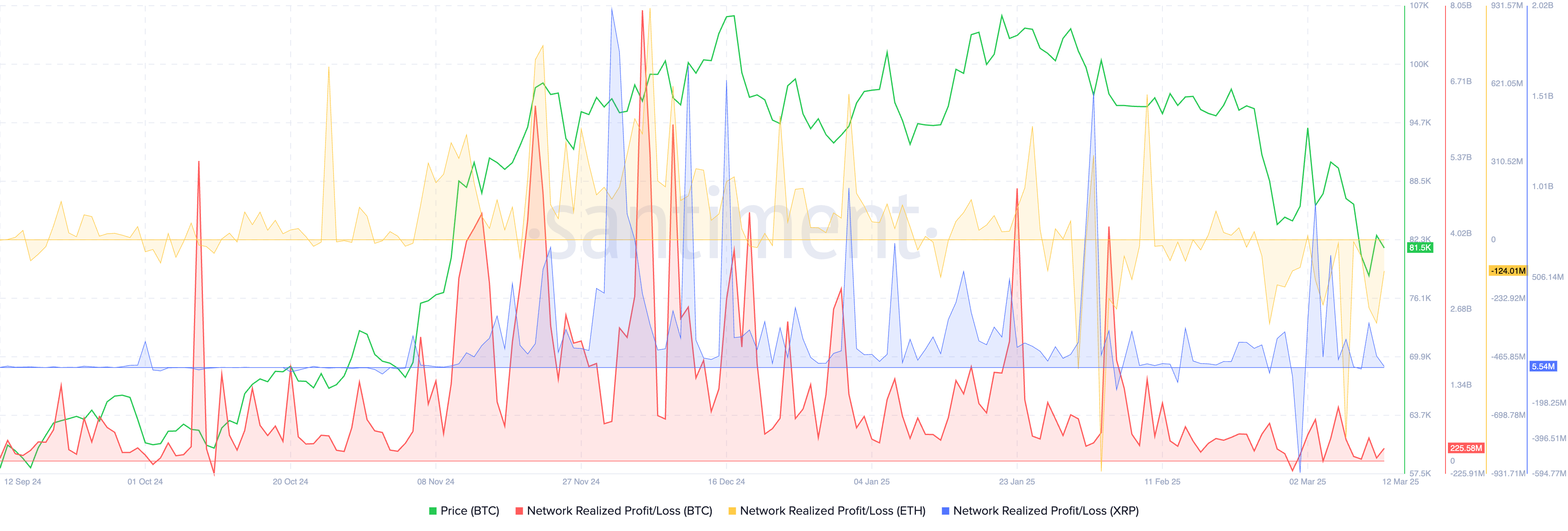

Bitcoin and XRP traders have consistently taken profits on their holdings since mid-February. However, in the case of Ethereum, the behavior of traders is akin to capitulation. Traders have realized losses on their Ether holdings, as seen by the negative spikes in the Network realized profit/loss metric on Santiment.

Capitulation is followed by stability in prices, however it remains to be seen whether Ether price will recover in the coming weeks and months.

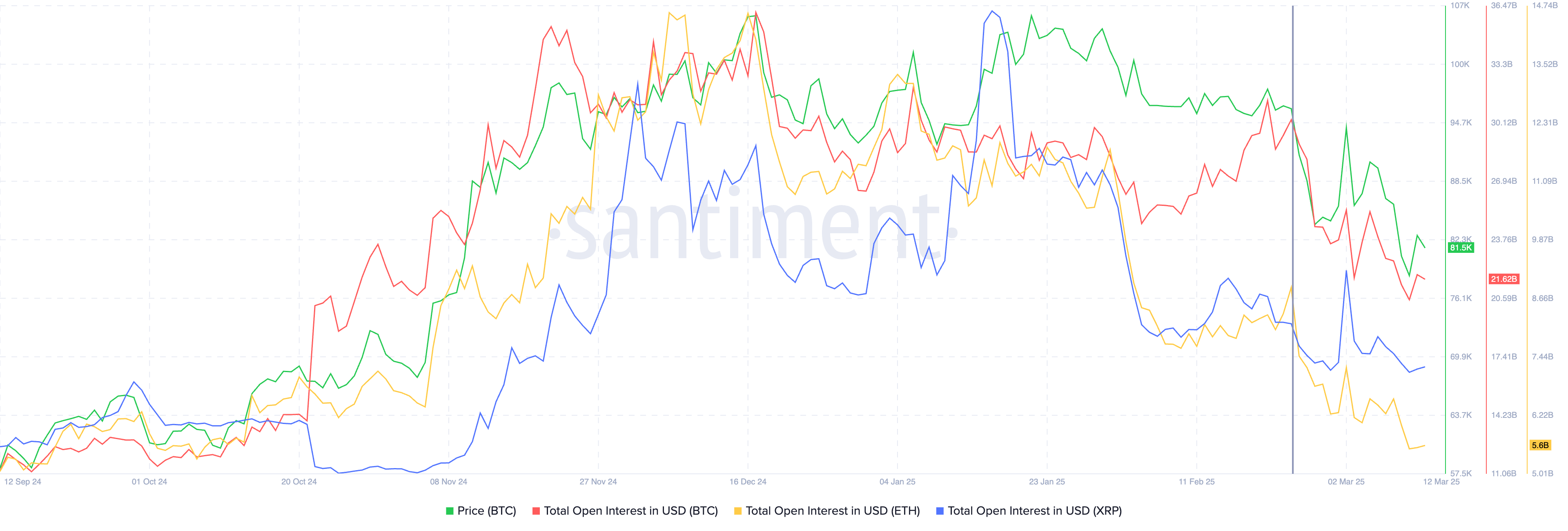

The total open interest in USD in the three tokens has shown a steady decline since the last week of February. This implies that derivatives traders are losing interest in the top 3 cryptos, in line with the risk-off sentiment and the U.S. stock market bloodbath.

As Bitcoin behaves more like a U.S. tech stock every day, the “Bitcoin as a hedge and safe haven” narrative takes a hit, and cryptos are identified as one of the risk-assets among alternative investments.

Is it the end of the Bitcoin bull run?

A crypto analyst behind the X handle @davthewave believes that the worst of the crypto market correction is behind us. Bitcoin bull run is far from over, and the analyst checks the box on five key pointers that support their thesis.

Thinking we've seen the worst of this #btc multi-month correction:

1] Multi-year diagonal support coming through

2] 0.38 fib retracement repeat

3] 0.5 fib retracement and resistance come support

4] Time fib through to end of April

5] one year moving average coming through pic.twitter.com/85XcPoAczW— dave the wave🌊🌓 (@davthewave) March 10, 2025

The average correction in Bitcoin price in the last three bull runs was between 24 and 32% in the years 2016-17, 2020-21 and 2023-24 respectively. The recent correction in BTC is therefore well within the average and does not directly signal the end of the bull market.

The crypto Bitcoin bull run index is a metric used to analyze nine different statistics to determine the stage of the market cycle. Indicators like PI Cycle, MVRV Z-Score and Reserve Risk are used to identify whether it is a Bitcoin bull or bear market.

In the last three cycles, every time CBBI crosses 90, Bitcoin hit a new all-time high. This hasn’t happened yet in the ongoing cycle, meaning there is a likelihood that the bull market is ongoing and BTC is likely to peak in the coming months of 2025.

Agne Linge, Head of Growth at WeFi shared written commentary with Crypto.news, commenting on rising market volatility in Bitcoin, in response to shifting macro conditions.

Linge said,

“Bitcoin has fluctuated between $79K and $85K over the past two weeks, reflecting heightened market volatility driven by mounting geopolitical and macroeconomic pressures. The market sentiment is tense, and trade tensions have escalated again, with new tariffs expected to be implemented on April 2nd. Today, new 25% tariffs on steel and aluminum imports have taken effect, prompting a swift retaliation from the European Union, which plans to impose counter measures on goods worth 26 billion euros (about £22 billion pounds) starting next month.

Heightened macro volatility and geopolitical tensions have driven investors toward safe-haven assets like the U.S. Treasuries, reflecting a broader shift toward capital preservation amid growing market uncertainty. Meanwhile, Germany’s decision to raise debt to finance a military buildup has triggered a sharp selloff in German government bonds (bunds), reinforcing the flight to U.S. Treasuries as investors seek greater stability.”

Bitfinex analysts told Crypto.news,

“Such widespread capitulation often precedes market stabilisation, though geopolitical and macroeconomic concerns remain a significant overhang.”

Dr. Sean Dawson, Head of Research at Derive.xyz told Crypto.news:

“The market is facing significant challenges as the macroeconomic environment worsens, and crypto assets are no exception.

With bearish sentiment building, traders are turning to downside hedging strategies, especially as volatility surges across both traditional and crypto markets. The coming weeks will be critical for assessing how the broader economic situation impacts digital asset prices and trading behaviour.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This news is republished from another source. You can check the original article here