The crypto market experienced strong reactions following the February 21 theft of $1.5 billion worth of 401,346.76 ETH from Bybit’s wallets. After the security incident occurred the price of Ethereum experienced an 8% decline. Bybit stated to customers that their funds stayed protected which eased the user fears while the incident was ongoing. Experts analyze both the Ethereum price projection following the Bybit hack and the $1.3 billion bridge loan involved in the incident.

Ethereum Price Drops After Bybit Hack

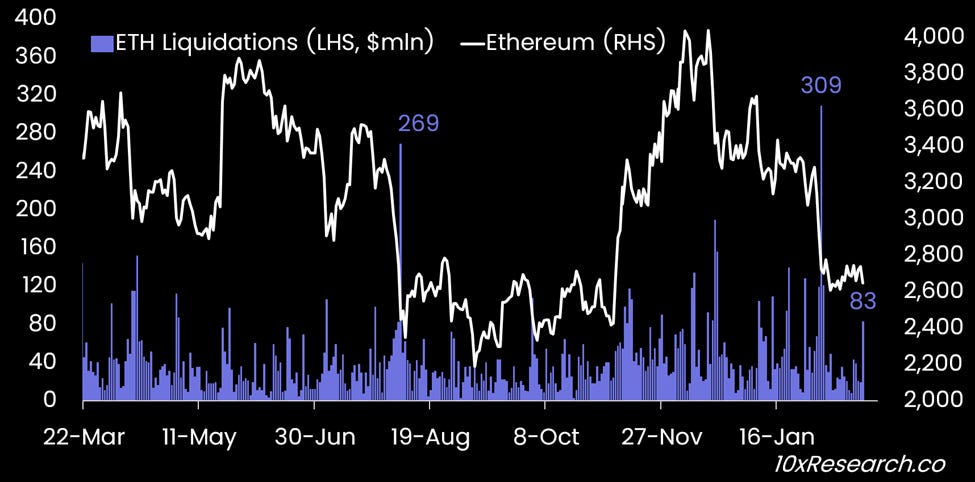

A masked User Interface (UI) attack revealed by hackers successfully extracted 401,346 ETH from Bybit’s cold wallet storage. The security analyst ZachXBT determined the US cybercriminal collective Lazarus Group was responsible for this security breach. The Ethereum market sustained an 8% price loss afterward with its price dropping from $2,845 to $2,614. Bybit CEO Ben Zhou verified that customers lost no funds throughout the exploit as the company processed 350,000 withdrawal requests successfully although remaining operationally solvent.

Bybit reacted to the attack by obtaining a $1.3 billion bridge loan. Bybit obtained Ethereum through borrowing and then performed an immediate sale to buy the asset later at a possibly lower price. The duration of delay at Bybit will increase loan risk. The upward movement of Ethereum prices has a potentially negative effect on both Bybit’s financial reserve strength and its partnership arrangements with lenders.

Bybit’s Bridged Loan and Its Potential Effect on Ethereum Price

Bybit’s adoption of a short Ethereum position through bridged loans carries multiple risks to its price. The price movement of Ethereum plays a key role in this strategy because stability or decrease creates successful outcomes. The price increase will create significant financial losses for Bybit during its ETH purchase attempt.

DeepSeek AI generated four possible price outcomes for Ethereum when Bybit executes its loan activities. Bybit maintains the ability to manage the bridged loan repayment through stable or declining Ethereum prices. The price range of Ethereum could settle between $3,500 and $3,700 in this situation. The losses faced by Bybit during an average Ethereum rally would reach $100 million but could need additional investment funding to sustain operations.

Bybit would face a critical cash shortage as a result of a sudden Ethereum price increase. Bybit would need an extra $2 billion and 402,000 ETH to acquire in case Ethereum moves above $4,000. Market participant activity that drives Ethereum prices upward would trigger an abrupt rise in Bybit’s repayment expenses leading to possible depletion of its capital reserves or default risk. Manipulation strategies could elevate Ethereum price to $5,500 or $6,000 but the market would likely reverse to $3,000 to $4,000 levels afterward.

Future Ethereum Price Predictions

The Ethereum price range now spans from $2,765 to $2,522 after February 3 and 21. The handling of their crisis by Bybit indicates that analysts predict market recovery. A lack of significant downward movement when Bitcoin reaches $100,000, will likely ignite bullish traction throughout the crypto marketplace. The subsequent strategic resistance zones influencing Ethereum’s value appear at $3,017 followed by $3,119 and then $3,300.

A break below $2,621 would trigger a severe price decrease that could send Ethereum down to $2,100 or possibly push it to $2,044. The disposal of stolen ETH might push Ethereum down to test $2,000 as support. Experience suggests that investors should consider taking advantage of purchasing opportunities at these market prices according to analyst assessments.

Long-Term Effects of the Bybit Hack on Ethereum

The Bybit hack has shown both the vulnerabilities of crypto security and how cryptocurrency exchanges handle emergencies. Operating stability from Bybit’s bridged loan exists yet Ethereum’s market value remains at risk from the sellers’ actions and debt payment requirements. The recovery timeline for Bybit depends on three main factors including loss-absorption capabilities and regulatory actions on North Korean hackers and market sentiment.

On-chain analytics show that the cybercriminals have transported 5,000 ETH to cryptographic blending services for fund cleaning. Periodic analysis tracks the situation because authorities attempt to stop additional illegal financial transactions.

This news is republished from another source. You can check the original article here