Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

On Dec. 7, according to sources cited by Reuters, discussions between the Securities and Exchange Commission (SEC) and asset management companies applying for spot Bitcoin ETFs delved into key technical details, indicating that the agency may soon approve these products.

Some of these details include regulatory arrangements, subscription, and redemption mechanisms.

According to insiders, anonymity was requested as the discussion was conducted privately. A spokesperson stated that BlackRock did not respond to a request for comment, Invesco declined to comment, and Grayscale noted that they will continue to have constructive contact with the SEC.

On Dec. 8, Bloomberg analyst Eric Balchunas announced on his social media platform that Fidelity’s spot Bitcoin ETF code has been designated as FBTC and listed on the Depository Trust and Clearing Corporation of the United States (DTCC).

On the same day, Ethereum core developer Timo Beiko summarized the 176th ACDE meeting on social media. The developers discussed the status of Denchun, the schedule for testnet, and how to plan for the next network upgrade.

According to the meeting discussion, Devnet # 12 was launched last week, and almost all clients are running on it. Errors have been discovered and fixed in several clients, including Reth and Lighthouse.

Meanwhile, the development team has prepared a fork testnet and plans to conduct a large-scale Goerli shadow fork in the coming weeks. Developers unanimously agreed that if things go smoothly, a Goerli fork date will be set in early 2024 to activate Denchun online in January. It is reported that the last ACDE meeting of 2023 will be held at 22:00 Beijing time on Dec. 21.

At the same time, asset management company VanEck posted its top 15 predictions for the crypto industry in 2024.

Specifically, it includes:

- The U.S. economic recession is approaching, but the first batch of Bitcoin spot ETFs will also be approved. In the first quarter of 2024, over $2.4 billion may Flow into these ETFs to support the price of Bitcoin.

- The fourth Bitcoin halving in 2024 will have minimal market disruption, and after the halving, Bitcoin prices will rise, leading to significant profits for some low-cost miners.

- The price of Bitcoin will reach a historic high in the fourth quarter of 2024, which may be driven by political events and regulatory changes after the US presidential election.

- Ethereum will not surpass Bitcoin but will still outperform major technology stocks. Other smart contract platforms will challenge Ethereum’s market share.

- After implementing EIP-4844, Ethereum L2 will capture the majority of EVM-compatible TVLs and trading volumes.

- NFT activities will rebound to historic highs, Ethereum will continue to lead, and Bitcoin will gain attraction through the Ordinals protocol. By the end of 2024, the NFT issuance ratio between ETH and BTC will reach 3:1.

- Binance will lose its spot trading position, and competitors like Coinbase will compete for a leading position. Coinbase’s futures market daily trading volume may exceed $1 billion.

- The market value of stablecoins will reach over $200 billion, reaching a historic high.

- DEX’s share in the spot trading market will reach a historic high.

- Remittances will promote the use of blockchain, and the “Bitcoin staking” on the Lightning Network provides revenue opportunities through new, user-friendly staking tools.

- A breakthrough blockchain game may have over one million daily players.

- Solana is expected to become one of the top 3 blockchains in market cap, TVL, and user count.

- DePin networks, especially Hivemapper and Helium, will be more widely adopted.

- The new accounting standards will increase companies’ holdings in cryptocurrencies.

- Decentralized finance (defi) applications that comply with know-your-customer (KYC) requirements, led by Uniswap, may exceed those that do not, attracting institutional transaction volume and increasing protocol fees.

According to a report released by CoinGecko, over half of the world’s countries/regions have legalized cryptocurrencies, including 119 countries/areas and 4 UK overseas territories. Europe is at the forefront of global crypto legalization, with 39 out of 41 analyzed countries (95.1%) recognizing its legitimacy.

Additionally, since the bear market bottomed out at the end of 2022, the proportion of holders who have not transferred Bitcoin within two to three years to the total token supply has significantly increased.

Last December, this investor group held approximately 8% of the supply of tokens, but now it accounts for over 15%. Although Bitcoin has seen a 165% increase this year, holders who purchased BTC between December 2020 and December 2021 did not choose to make significant profits and leave the market.

According to Deribit data, BTC options with a nominal value of nearly $1.399 billion and ETH option contracts with a nominal value exceeding $458 million will expire and be delivered on Friday, Dec. 7. The maximum pain point price for BTC is $40,000; The maximum pain point price for ETH is $2,100, reminding investors to pay attention to market changes.

Trends of main coins

Bitcoin

Bitcoin price continues to stabilize around the $42,000 mark this week. In the short term, there might be a gradual decline in testing the $42,015 support.

Two high targets persist at $45,345 and $47,990.

Long-term bullish targets are $120,400 and $128,350, with a medium pullback expected in Q1 2024.

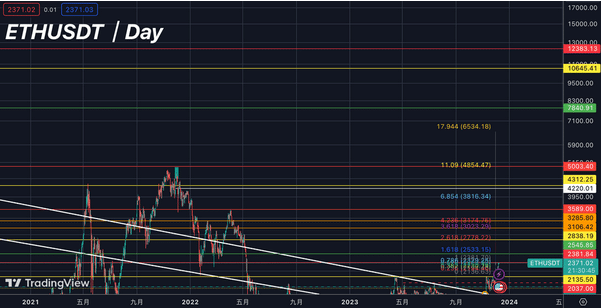

Ethereum

Ethereum achieved the upward price target of $2,381, reaching a high of $2,382. In the short-term, it is expected to test the $2,381 resistance multiple times. The possibility of an upward trend is anticipated, with targets at $2,545. Long-term bullish targets are set at $8,000 and $12,300.

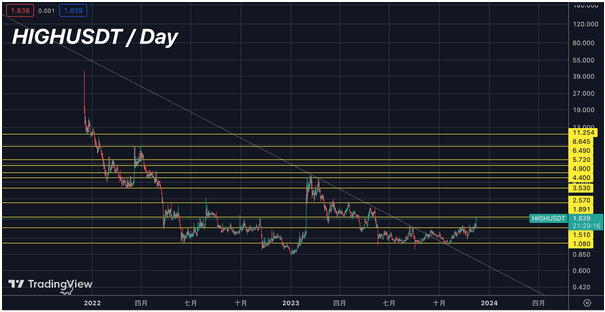

HIGH

The weekly chart of Highstreet completes a golden cross retracement, closing above the $1.586 level. Breaking the first resistance at $1.882, the next price target for HIGH is $2.233. Deviations on the daily and weekly charts suggest a continued uptrend this week. Utilizing a low-risk ratio for position building is suggested for long-term gains.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

This news is republished from another source. You can check the original article here