Bitcoin’s (BTC) price rose slightly during Asian trading hours on Wednesday, approaching the critical resistance zone around $62,000. Coinglass data shows a second consecutive day of slight inflows into US-listed Bitcoin Spot ETFs, but BTC seems unable to overcome a key resistance level and on-chain data indicates increased activity in dormant wallets that suggests a potential bearish shift ahead.

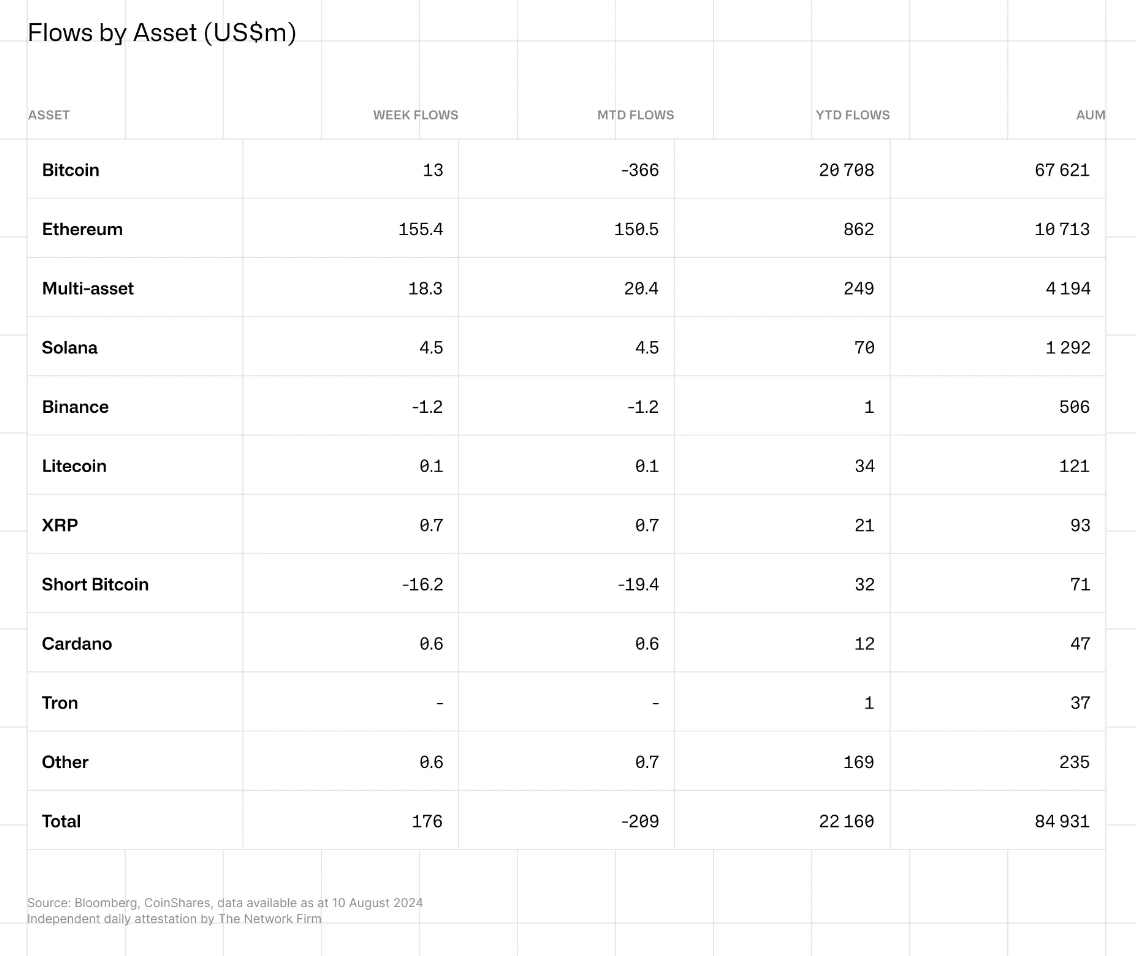

Goldman Sachs, the seventh largest bank in the US, filed a 13F disclosure with the Securities & Exchange Commission (SEC) on August 13, disclosing nearly $420 million invested in seven Bitcoin Exchange Traded Funds (ETF). At a time when crypto traders are looking for developments in the Solana and XRP ETFs, the news brings confidence in institutional capital inflow to crypto investment products.

The cryptocurrency market added 2.2% in the last 24 hours to reach $2.14 trillion, a fresh attempt to climb into the upper half of last month’s trading range from where last week’s sell-off was intensified. Over the past 24 hours, the macroeconomic background has been favourable for risk appetite thanks to slowing producer prices and New Zealand’s key rate cut.

This news is republished from another source. You can check the original article here