On-chain data shows increased accumulation from Bitcoin and Ethereum whales despite market-wide bearish momentum.

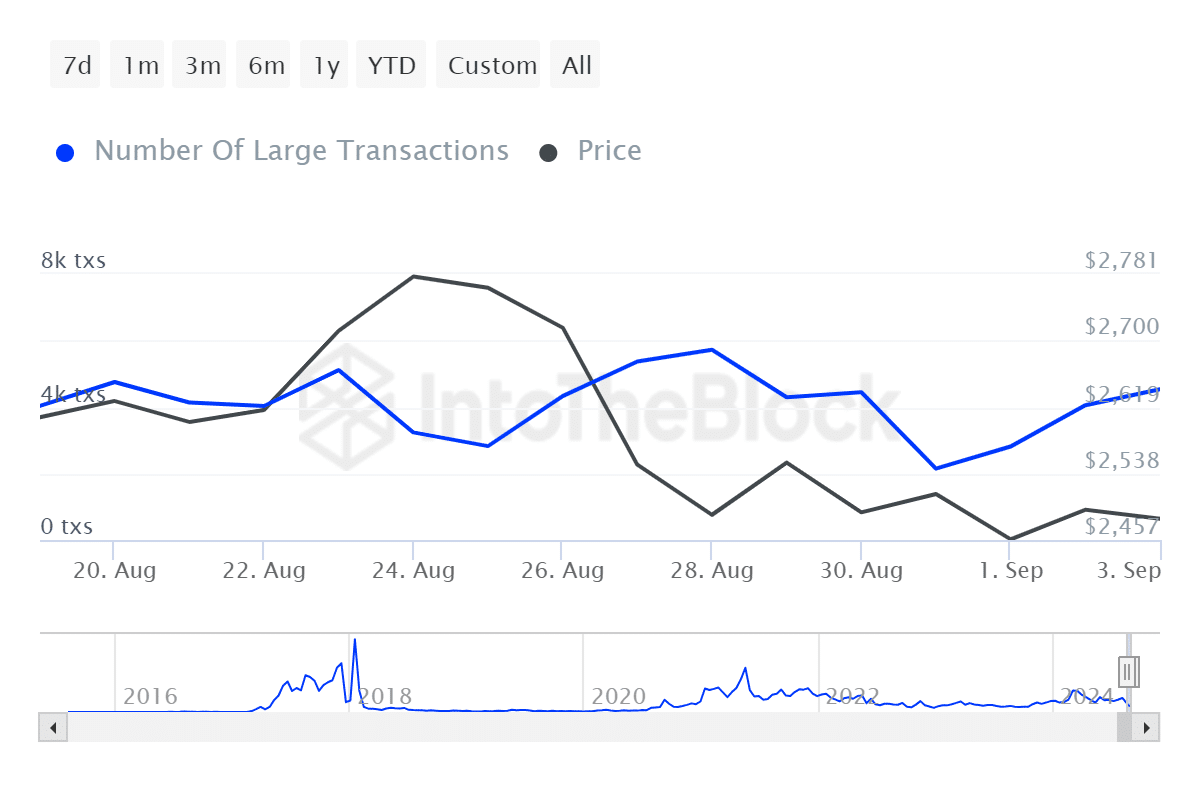

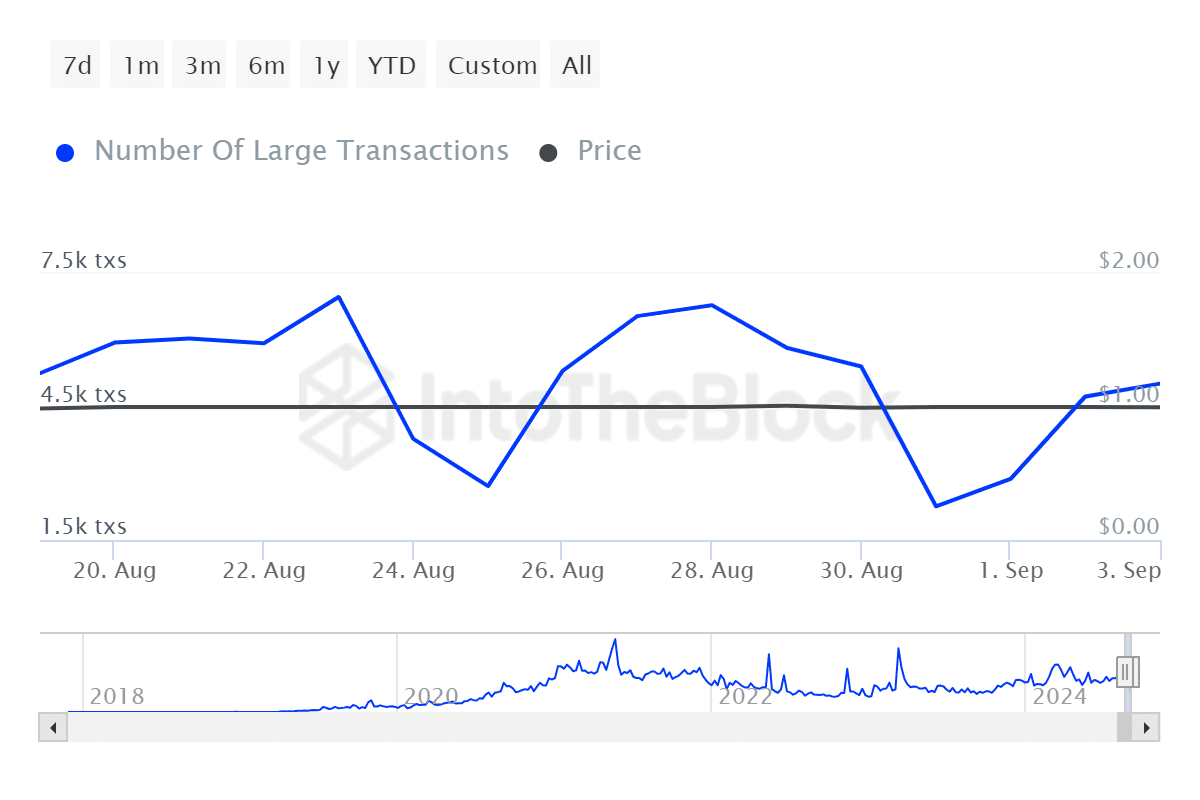

According to data provided by IntoTheBlock, the number of large Bitcoin (BTC) and Ethereum (ETH) transactions, worth at least $100,000, started to increase on Sept. 1 after a set of constant declines in the last week of August.

The number of large BTC transactions surged from 13,100 on Sept. 1 to 18,000 on Sept. 3. Ethereum witnessed a similar momentum. Whale transactions consisting of at least $100,000 worth of ETH rose from 2,150 on Aug. 31 to 4,530 on Sept. 3, per ITB data.

Data shows that whales have also started moving the largest stablecoin by market cap, Tether (USDT). According to data from ITB, the number of large USDT transactions increased from 2,260 on Aug. 31 to over 5,000 on Sept. 3.

On Sept. 3, the two largest cryptocurrencies witnessed exchange net outflows of 7,290 BTC and 71,370 ETH, worth over $585 million combined. This movement shows increased accumulation while the broader crypto market is wandering in uncertainty.

On the other hand, USDT registered roughly $66 million in exchange net inflows on the same day. Usually, rising stablecoin inflows into centralized exchanges could hint at increased Bitcoin and altcoin purchases.

Per a crypto.news report, over $1 billion worth of BTC left the exchanges between Aug. 26 and Sept. 2.

Today, both Bitcoin and Ethereum faced a downward momentum. BTC fell by 3.5% and is trading at $56,700 at the time of writing. ETH slipped 4% and is currently trading at $2,400.

This news is republished from another source. You can check the original article here