Bitcoin is still due for more sideways turbulence—and potentially some more bleeding—before shooting to the sky later this month, according to BitMEX co-founder Arthur Hayes.

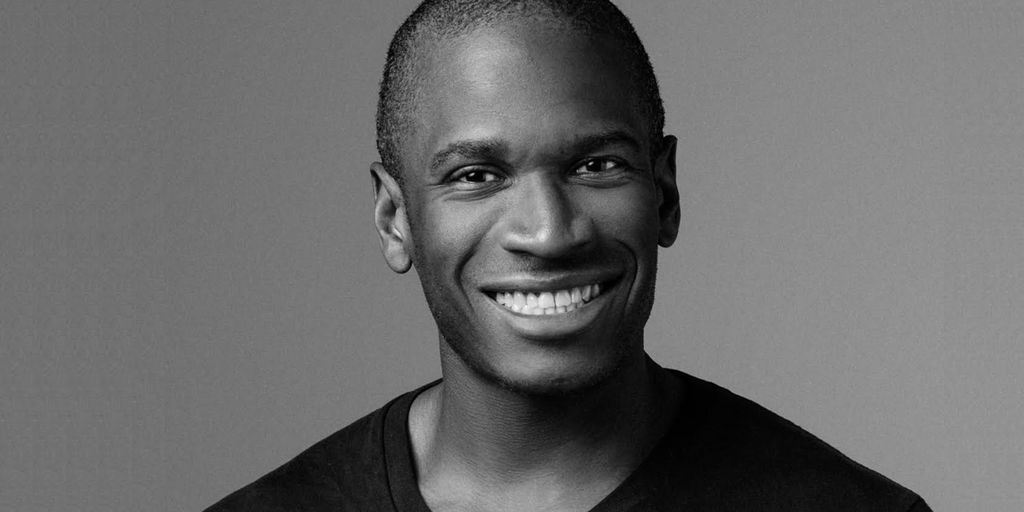

In his latest piece, the famous crypto essayist and macro-analyst admitted that his previous prediction that Bitcoin’s bull market would “begin anew” in September was incorrect, but that his bearishness remains “temporary.”

“I have changed my mind, but it doesn’t affect my positioning at all. I’m still long as fuck in an unlevered fashion,” he wrote on Tuesday.

Rather, Hayes has simply delayed his bullish expectations by a few weeks as he waits on the Federal Reserve and U.S. Treasury to pump emergency liquidity into the market. This liquidity, he claims, will likely come from the Treasury General Account—and from a potential restart of quantitative easing meant to maintain stability in the treasuries market.

“I expect intervention to begin in late September,” he added. “Between now and then, Bitcoin, at best, will chop around these levels and, at worst, slowly leak lower towards $50,000.”

Bitcoin initially pumped to $64,000 following Fed chairman Jerome Powell’s promise to begin lowering interest rates last month. Lower interest rates mean cheaper borrowing costs, which have largely proven to be bullish for scarce assets and stocks, such as BTC.

In an essay last week, Hayes described the pump as a “sugar high” that would likely die out as the Japanese yen began to see relative strength, potentially killing the “yen carry trade” that’s buoyed asset prices.

But Hayes soon learned there was another factor at play. The Fed’s Reverse Repo Program (RRP) began to see more deposits following Powell’s speech, rising because of their relatively higher yield compared to US Treasury bills. According to Hayes’s theory, a rising RRP “sterilizes” money, unable to be re-leveraged within the financial system, and therefore can’t boost asset prices.

“Assuming the Fed doesn’t cut rates before the September meeting, I expect T-bill yields to stay firmly below those of the RRP,” Hayes explained.

In the long term, Hayes expects rate cuts to boost 10-year Treasury bond yields up toward 5%. Given that the Treasury deemed it necessary to inject liquidity into the market when yields approached this level last year, Hayes expects the government to repeat the same playbook, and once again boost Bitcoin.

Should Yellen not boost markets fast, he believes it could cost Kamala Harris the election in November.

“Given these circumstances and Yellen’s dogged loyalty to the Democratic party’s Manchurian candidate Kamala Harris, those red bottoms ‘bout to stomp all over the ‘free’ market.” he said.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

This news is republished from another source. You can check the original article here