Bitcoin shows a negative price trend which stays at a value close to $96K following short-lived bullish momentum due to U.S. job figures. The cryptocurrency will experience a short downward movement to reach $90K according to analyst predictions before continuing its positive trend. Market sentiment changes have led experts to provide explanations about Bitcoin’s future market performance.

Bitcoin Price Trends and Market Sentiment

Bitcoin shows current trading values located at $96,000 which indicates a minor reduction compared to yesterday’s rates. The crypto market maintains a price range between $90K to $100K while market uncertainties produce negative effects on investor opinions. BTC faces additional price decreases according to analysts who believe the move will prepare the market for a fresh all-time high.

The Bitcoin market analysis expert Michael van de Poppe stated that the cryptocurrency has entered a phase where prices fail to move significantly. The price area at $90K serves as an important entry point for investors because it could trigger their interest to purchase. The analyst stated that crossing above $104K might indicate the beginning of a robust price momentum.

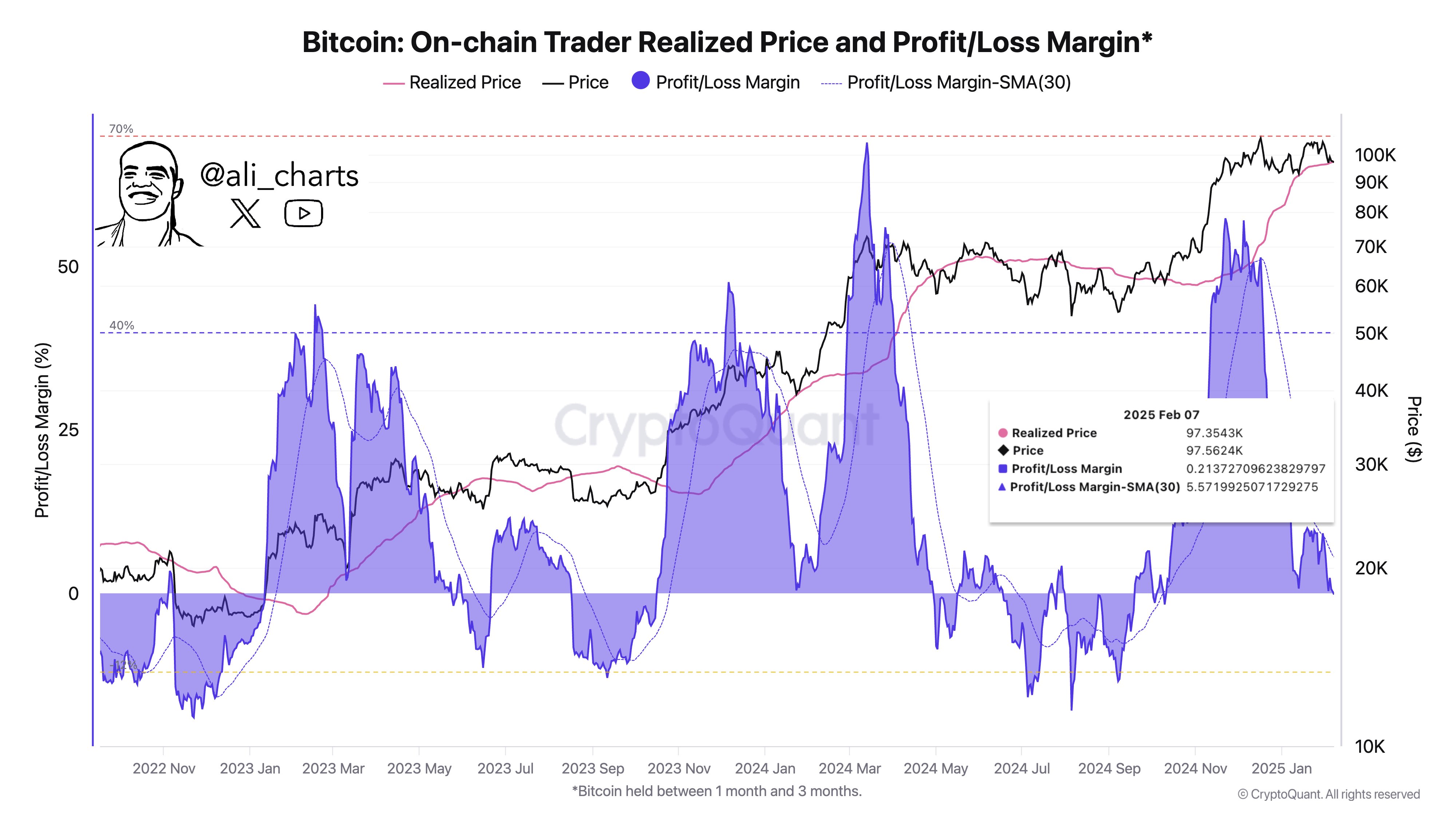

According to market specialist Ali Martinez Bitcoin demonstrates its most advantageous buying point during trading periods that produce a 12% loss. The small profit held by traders right now points toward additional BTC price reduction before the market shows a sustained upward movement.

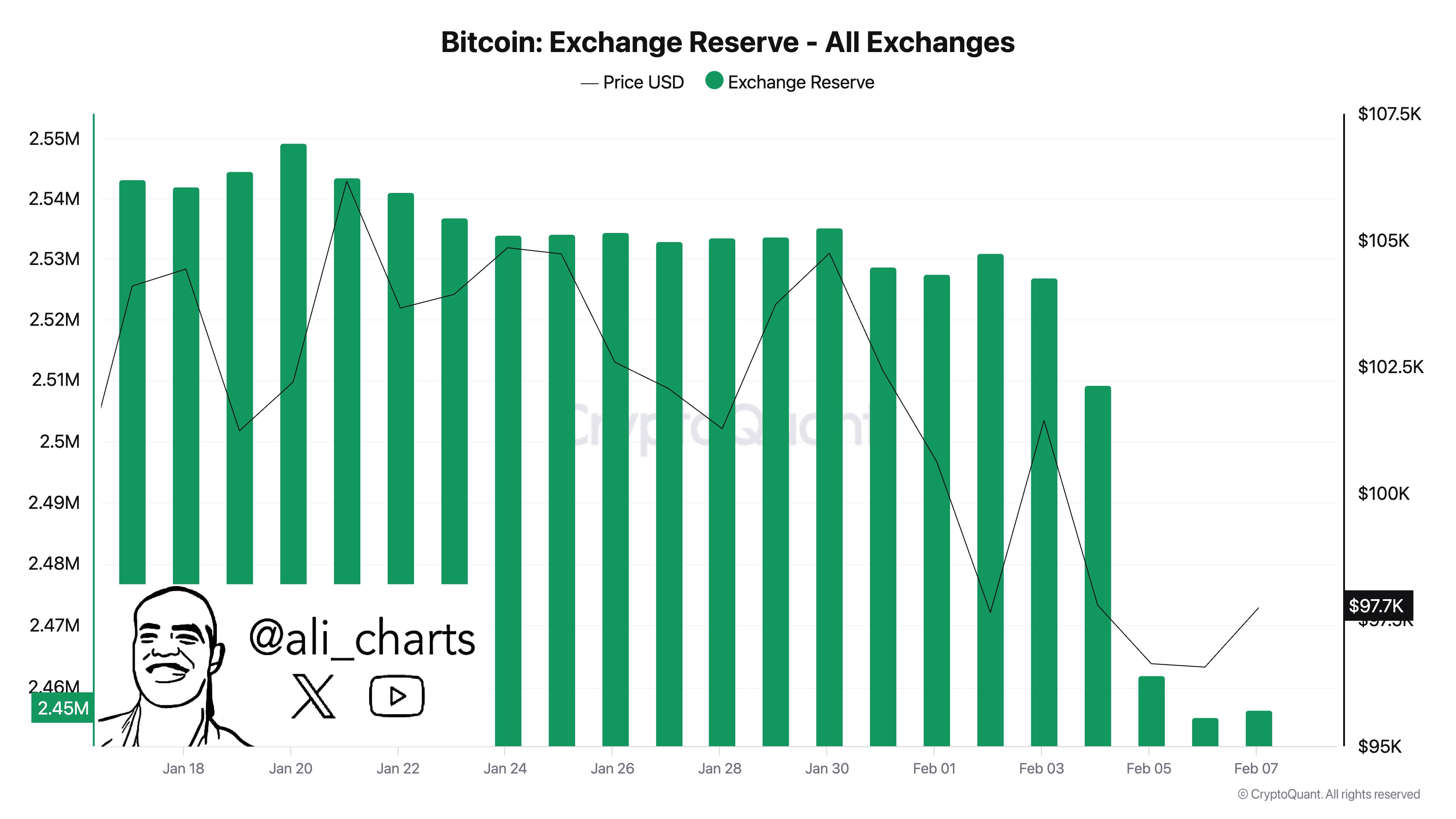

Exchange Outflows Signal Investor Confidence

Analytics indicate long-term investors maintain their trust in the market despite current price movement. In the past week, Martinez reports that exchanges experienced the withdrawal of over 70,000 BTC. Large withdrawal amounts from exchanges reveal investors are shifting their funds into private wallets instead of planning for sales.

Exchange supply reductions tend to result in less market selling pressure which historically happens before significant Bitcoin price increases. An ongoing decrease in exchange supply might provide conditions for Bitcoin to regain upward price movements.

US Job Data and Interest Rate Expectations

Bitcoin’s market value continues to be influenced strongly by decadal economic indicators. The latest U.S. employment statistics show a declining demand for workers thus giving the Federal Reserve additional flexibility to implement interest rate cuts. Reductions in interest rates drive investors away from traditional investments thus boosting the demand for Bitcoin as a risk asset.

Bitcoin briefly crossed the $100K threshold when the job statistics were disclosed but subsequently declined. Financial experts predict that Federal Reserve rate reductions will increase BTC investor interest thus boosting its value.

Bitcoin Reserve Speculations and Regulatory Developments

The debate about using Bitcoin as a reserve asset has recently begun gaining widespread acceptance. U.S. federal officials and multiple states currently studying the creation of Bitcoin reserve systems while reports demonstrate their evaluation of launching a United States Bitcoin Strategic Reserve. The movement of these Bitcoin reserve plans forward will strengthen Bitcoin’s standing in financial systems.

Experts follow U.S. regulatory changes because they anticipate the United States will adopt friendly policies toward cryptocurrency. New positive regulatory policies from policymakers would improve investment trust in Bitcoin and overall crypto assets.

What’s Next for Bitcoin?

The cryptocurrency exchange rate for Bitcoin holds at $95,943 while consuming $50.8 billion during daily trading activities. Bitcoin hit $100,154 as its peak value before reaching its daily bottom point at $95,653. The Bitcoin Relative Strength Index stands at 41 which indicates forthcoming momentum based on current data.

The price movements of Bitcoin are now unclear but analysts predict that its long-run prospects are positive. Market experts expect BTC to reach $150K within the next few months which strengthens positive price trends despite momentary market fluctuations.

This news is republished from another source. You can check the original article here