The creation of a crypto token marks the beginning of an exciting venture in the digital currency space. This comprehensive guide is designed to walk you through the journey of how to create a crypto token, from the initial concept to its final launch. Whether you are wondering how to create a DeFi token or how to create a meme token, or another type of digital asset, we cover all the essentials you need to know.

We’ll delve into the specifics of each developmental phase, address how much does it cost to create a crypto token, legal aspects, and even provide insights on how to create a crypto token for free. With a focus on clarity and expert guidance, this guide is your doorway to successfully navigating the intricate process of crypto token creation.

Basics: How To Create A Crypto Token

Creating a crypto token is an intricate process that combines technical skills with a deep understanding of the blockchain ecosystem. This task requires not just programming prowess but also a strategic approach to ensure your token aligns with market needs and regulatory standards.

The concept of a crypto token encompasses a digital asset built on a blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum, which are native to their respective blockchains, tokens are created using the existing blockchain’s infrastructure. They represent various assets or utilities, from digital art and virtual real estate to governance rights within a decentralized network.

Remarkably, the history of crypto tokens is marked by significant events, notably the ICO (Initial Coin Offering) boom around 2017. This period witnessed a surge in token creation, as startups and projects used ICOs to raise capital by issuing tokens. While this led to groundbreaking innovations, it also attracted scrutiny due to the prevalence of scams and lack of regulation.

A recent success story in the crypto token space is PEPE coin, launched on April 16, 2023. It quickly gained popularity, notably among memecoin enthusiasts. PEPE coin, developed as a tribute to the meme character Pepe the Frog, reached a market cap of $1.61 billion in less than three weeks after its launch.

Step-by-Guide: How To Create A Token

Creating a crypto token is a complex process, requiring a blend of technical expertise and strategic planning. Here’s a more detailed guide on “how to create a crypto token”:

#1 Specify The Purpose Of Your Token

The purpose of your token is foundational. Are you creating a utility token to facilitate transactions within a specific ecosystem, a security token to represent digital shares of an asset, or a governance token to allow holder participation in decision-making? Understanding and clearly defining the utility, target audience, and problem your token addresses is critical for its relevance and success.

#2 Choose A Blockchain

Your choice of blockchain affects the token’s functionality, scalability, and security. Consider Ethereum for its well-established infrastructure and strong support for ERC-20 tokens. Other blockchains like Binance Smart Chain or Cardano offer different advantages like lower transaction fees or enhanced scalability. Assess the community support, development tools, and consensus mechanisms of each blockchain to find the best fit for your token.

#3 Create A Whitepaper

A whitepaper is crucial for gaining trust and interest. It should comprehensively detail your token’s purpose, technology, governance model, and economic mechanics. Include technical details, projected use cases, and a clear roadmap. A good whitepaper is transparent about the token’s features, risks, and long-term vision, helping to establish credibility among potential investors and users.

#4 Set Up A Node

Setting up a node on the Ethereum network is a critical step for anyone looking to create a token. This process is essential because it ensures direct and reliable access to the blockchain. By operating a node, creators maintain a personal copy of the entire Ethereum ledger, allowing for real-time tracking of transactions and network activity. This direct connection to the Ethereum network not only enhances security but also provides greater control over the transactions associated with the token.

#5 Develop Smart Contracts And Test Them

Smart contracts are the core of your token’s functionality on the blockchain. They must be coded carefully to manage the token’s operations securely and efficiently. Post-development, testing these contracts on a testnet is vital to identify and fix vulnerabilities, ensuring reliability and security. This stage may involve multiple iterations to refine the contract’s functionality.

#6 Deploy On Mainnet

Deploying your token on the mainnet brings it to life. This step requires precision and often a fee, known as gas in Ethereum. Ensure your smart contracts are thoroughly tested before this step, as deploying on the mainnet makes the contracts immutable and any errors irreversible.

#7 Distribute And Market

Develop a strategy for distributing your token. This might involve initial offerings like ICOs, airdrops to potential users, or partnerships with exchanges for listing. Marketing is key to building awareness and credibility. Utilize social media, community engagement, and partnerships to spread the word about your token and its use cases.

#8 Maintain And Update

Post-launch, it’s essential to maintain your token’s ecosystem. This includes monitoring the token’s performance, updating smart contracts as needed, and responding to community feedback. Regular updates and improvements will help maintain the token’s relevance and value in a rapidly evolving market.

Coding Necessary? How To Create A Crypto Token

Creating a crypto token, especially on Ethereum, involves a combination of coding skills and the use of specific tools and frameworks. The process can vary from straightforward to complex depending on the approach and tools used. Here are some aspects on how to create a crypto token on Ethereum:

- Solidity: This is a programming language designed for developing smart contracts on the Ethereum blockchain. It shares similarities with JavaScript and C++, but includes additional features and syntax tailored for Ethereum smart contract development.

- Smart Contract Features: A basic token contract in Solidity typically includes features like token name, symbol, decimal places, total supply, a mapping of addresses to their token balance, and functions for token transfer.

- Security Measures: Implementing security measures is crucial in smart contract development to prevent unauthorized access or theft of tokens. Best practices include using the latest version of Solidity, applying open-source libraries like OpenZeppelin for enhanced security features, thorough code testing, and code review.

Development Tools And Frameworks: How To Create A Token

- Moralis: A platform that simplifies the creation of dApps and ERC-20 tokens, requiring minimal development skills. Moralis provides tools for creating Ethereum tokens in a few steps, beneficial for those familiar with the basics of Solidity and smart contracts.

- Node Providers: Access to an Ethereum node is necessary for deploying tokens on the network. Moralis offers Speedy Nodes, which are fast and reliable nodes supporting multiple networks including Ethereum.

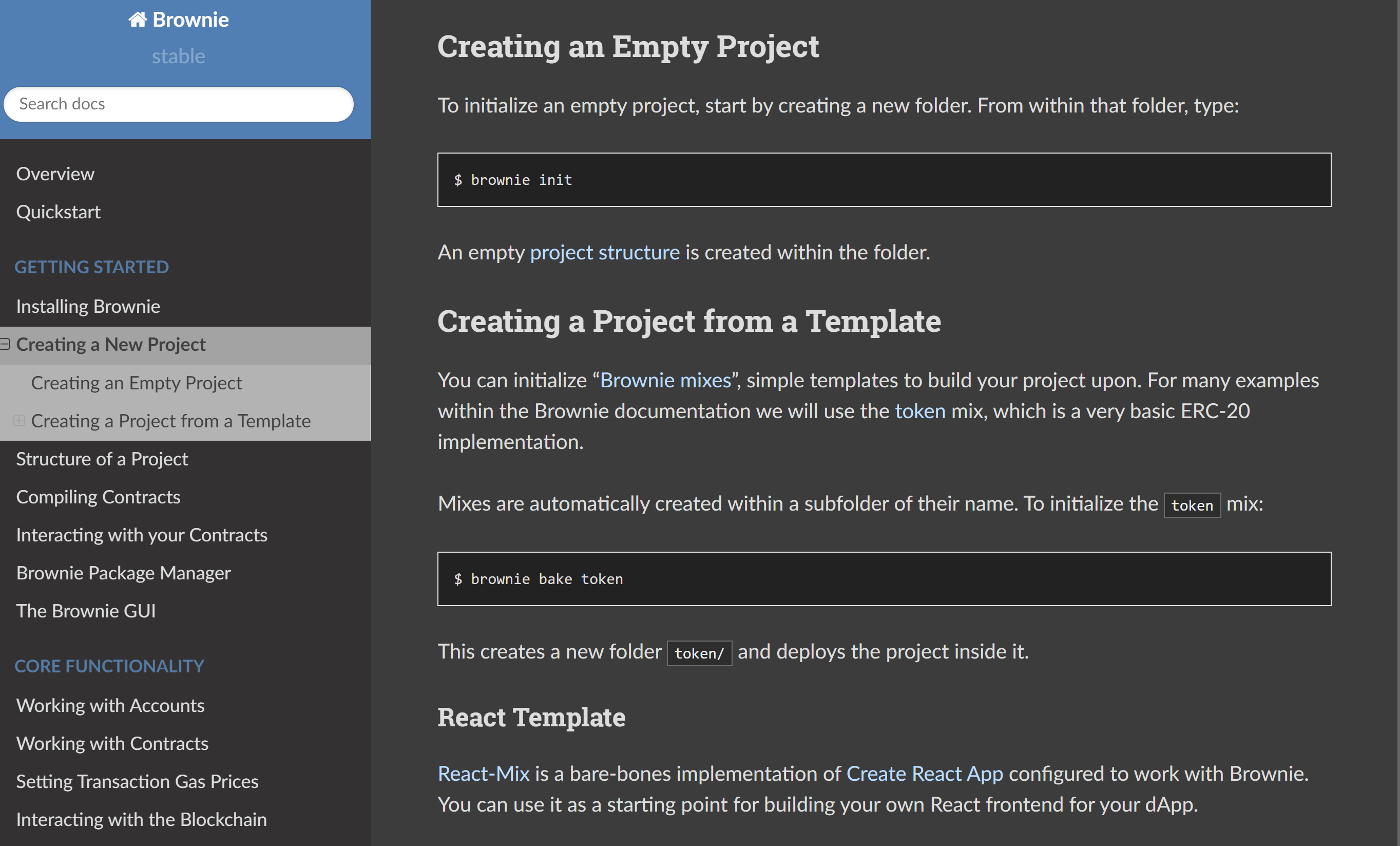

- Brownie: A Python-based development and testing framework for Ethereum. It’s an alternative to more traditional frameworks like Truffle Suite and Hardhat, and it simplifies the process of token development and deployment.

No-Code Token Creation

While traditional token creation involves substantial coding, several no-code or low-code platforms have emerged. These platforms offer a user-friendly interface for creating tokens without writing code from scratch. However, they typically offer less customization and control than a fully coded solution.

- TokenFi: This platform has launched a Token Launcher on testnet on November 23, 2023. It allows users to create tokens on the Ethereum Goerli chain without any coding. It’s accessible via desktop or mobile web browsers and integrated into platforms like Telegram and Discord, making token creation accessible to a wider audience without technical expertise.

- SmartContracts.Tools’ Token Generator: This tool simplifies token creation on Ethereum and Binance Smart Chain, allowing users to tokenize ideas without coding.

Learning Resources On How To Create A Crypto Token

There are numerous tutorials and guides available online for learning Solidity and smart contract development. Ethereum.org, for example, offers a curated list of community tutorials covering various aspects of Ethereum development including token creation using Solidity.

In summary, while traditional token creation on Ethereum requires coding skills, particularly in Solidity, there are tools and platforms like Moralis and TokenFi that simplify or even eliminate the need for coding.

However, for complex and unique token projects, proficiency in Solidity and a deep understanding of smart contract development remain crucial. Security is a paramount consideration in this process, and leveraging frameworks like Brownie and using libraries like OpenZeppelin can enhance the security and functionality of the tokens created.

Cost Analysis: How Much Does It Cost To Create A Crypto Token?

The cost of creating a crypto token can vary widely depending on several factors, including the blockchain platform used, the complexity of the token’s functionality, and whether you’re hiring developers or using no-code platforms. Here’s a breakdown of the key cost components:

1. Blockchain Platform Fees

Gas Fees: On platforms like Ethereum, you need to pay gas fees for transactions, including deploying smart contracts. These fees can fluctuate based on network congestion.

Token Standards: Different token standards (e.g., ERC-20, ERC-721) may have varying deployment costs due to their complexity.

2. Development Costs

Hiring Developers: If you’re not coding the token yourself, hiring experienced blockchain developers can be a significant expense. Rates vary widely based on expertise and location.

DIY Approach: If you have the coding skills, you can save on development costs. However, consider the opportunity cost of your time.

3. No-Code Platform Fees

Subscription or Service Fees: Some no-code platforms for token creation might charge a subscription or a one-time fee. These are generally more cost-effective compared to hiring developers.

Example Platforms: Tools like SmartContracts.tools offer user-friendly interfaces for token creation, but they come at a price.

4. Legal and Compliance Costs

Regulatory Compliance: Depending on the token’s nature (utility vs. security), legal fees for ensuring compliance with relevant regulations can be substantial.

Jurisdiction: Costs also vary based on the legal jurisdiction and the complexity of the legal landscape related to cryptocurrencies.

5. Marketing and Promotion

Marketing Campaigns: To gain traction, budgeting for marketing and community engagement is vital. This can include social media advertising, community management, and PR activities.

Exchange Listings: Getting your token listed on exchanges might incur fees, which vary from exchange to exchange.

6. Maintenance and Updates

Ongoing Development: Post-launch updates and maintenance, especially for complex tokens with evolving features, can incur ongoing costs.

Security Audits: Regular security audits are critical for maintaining the token’s integrity and user trust.

The cost of creating a crypto token is highly variable and can range from relatively low (using no-code platforms) to quite high (custom development with ongoing maintenance and legal compliance). It’s essential to thoroughly assess your project’s specific needs and budget accordingly, keeping in mind both upfront and ongoing expenses.

How To Create A DeFi Token?

Creating a DeFi (Decentralized Finance) token involves additional considerations compared to other types of crypto tokens. DeFi tokens are typically used within specific financial applications on the blockchain, offering functionalities such as lending, borrowing, yield farming, or liquidity provision. Here’s how the creation of a DeFi token differs:

1. Define The Financial Utility

Unique Functionality: Unlike standard tokens that might simply represent value or ownership, DeFi tokens often have complex financial functionalities embedded within them. This could include governance rights, profit sharing, or mechanisms for staking and earning rewards.

Use Case Alignment: The token’s utility must align closely with the specific DeFi application it is intended for, whether it’s a lending platform, a decentralized exchange, or a yield farming protocol.

2. Advanced Smart Contract Development

Complex Logic: DeFi tokens require more sophisticated smart contracts with intricate logic to handle various financial operations. This might include integrating interest rate models, reward distribution algorithms, or liquidity pool mechanisms.

Security Emphasis: Given the financial nature and the potential for substantial funds to be involved, DeFi tokens necessitate rigorous security measures, including thorough smart contract audits by reputable firms.

3. Integration With DeFi Protocols

Protocol Compatibility: DeFi tokens need to be compatible with existing DeFi protocols and platforms. This may involve adhering to specific standards beyond the basic ERC-20, such as ERC-721 for unique tokens or newer standards like ERC-1155.

Interoperability: DeFi tokens often benefit from being interoperable with multiple protocols and chains to maximize their utility within the broader DeFi ecosystem.

4. Governance And Decentralization

Governance Mechanisms: Many DeFi tokens come with built-in governance features, allowing token holders to vote on decisions affecting the protocol. This requires additional smart contract functionality.

Community Building: A strong and engaged community is crucial for the success of a DeFi token, more so than for other types of tokens. Community governance and active participation can be vital drivers of value and trust.

5. Regulatory Compliance And Legal Considerations

Financial Regulations: DeFi tokens might be subject to different regulatory scrutiny compared to other tokens, especially if they resemble financial instruments or involve yield generation. Legal guidance is critical to navigate this complex landscape.

Anti-Money Laundering (AML) And Know Your Customer (KYC): Depending on the token’s use case and jurisdiction, compliance with AML and KYC regulations may be necessary.

Creating a DeFi token is a more complex endeavor, requiring advanced smart contract capabilities, a deep understanding of financial mechanisms within the DeFi space, and a strong emphasis on security, governance, and regulatory compliance. This complexity often translates to higher development costs and the need for specialized expertise, both in technology and finance.

How To Create A Meme Token?

Creating a meme token, which is typically inspired by internet memes and often characterized by its virality and community-driven nature, differs from creating conventional crypto tokens in several ways.

Here’s an exploration of these differences:

1. Concept and Community Engagement

Pop Culture Inspiration: Unlike traditional tokens, meme tokens often originate from popular culture references or internet phenomena. Their appeal is heavily tied to the whimsy and humor they represent.

Community-Driven: The success of a meme token largely depends on the strength and engagement of its community. These tokens thrive on social media hype, influencer endorsements, and community activities.

2. Marketing And Virality

Marketing Strategy: While traditional tokens might focus on utility and technical aspects in their marketing, meme tokens rely heavily on virality and social media presence. Memes, humorous content, and engagement strategies are crucial.

Influencer Partnerships: Collaborations with influencers and prominent figures in the crypto space can significantly boost a meme token’s visibility and adoption.

3. Simplicity In Functionality

Basic Smart Contract Features: Meme tokens usually don’t require complex functionalities. Many are created as standard ERC-20 tokens on Ethereum or similar standards on other blockchains, with a primary focus on transferability and exchange listings.

Rapid Development And Deployment: Owing to their simplicity, meme tokens can be developed and launched quickly, often riding the wave of a trending topic or meme.

4. Tokenomics And Supply

High Supply And Low Price: Meme tokens often have a very high total supply, contributing to a low per-token price. This strategy creates a psychological appeal, as investors can own millions, billions, or even trillions of tokens for a small amount of capital.

Token Burns And Scarcity Tactics: Some meme tokens employ mechanisms like token burns to reduce supply over time, creating a deflationary model to drive up value.

Creating a meme token is more about capitalizing on cultural trends and building a strong, engaged community than about technical complexity or utility. The focus is on marketing, social media engagement, and riding the wave of virality. While they offer an interesting case study in the power of community in the crypto world, meme tokens also carry a higher risk due to their speculative nature and market volatility.

Bonus Tip: How To Create A Crypto Token For Free?

Creating a crypto token for free is a feasible option, especially if you’re looking to experiment or learn about the token creation process without financial commitment.

Consider using Ethereum’s testnets like Ropsten, Rinkeby, or Kovan, where deploying tokens does not require real gas costs. These testnets are designed for experimentation and are an ideal playground for beginners. Alternatively, blockchains with lower transaction fees than Ethereum’s mainnet, such as Solana, Cardano or Polygon, can be used to reduce costs.

Tools like Remix IDE, an open-source web tool for Ethereum, allow you to write, test, and deploy smart contracts in Solidity without any cost. Additionally, Truffle Suite and Ganache offer environments for testing Ethereum smart contracts locally, saving on gas fees and making the development process entirely free.

More Tools And Libraries

There are platforms like SmartContracts.tools that offer no-code solutions for creating tokens. These platforms typically have free tiers or options that enable basic token creation without incurring costs. TokenFi and similar platforms also provide interfaces for simple token creation on testnets or mainnets, allowing customization of token parameters without the need for coding skills or financial investment.

The OpenZeppelin library offers a collection of secure smart contract templates, including standard ERC-20 and ERC-721 contracts, which can be customized for your token at no cost. Additionally, GitHub repositories are a rich source of smart contract code shared by developers, which can serve as a starting point for your token.

For guidance and support, turning to forums like Ethereum Stack Exchange, Reddit, or Discord channels can be invaluable. These platforms host a community of experienced developers who often offer advice and help without charge.

How To Create A Crypto Token: Legal Considerations

Creating a crypto token involves navigating a complex legal landscape, which is as crucial as the technical development itself. Ensuring legal compliance not only protects the creators but also the users of the token. Here’s an overview of the legal considerations involved:

Regulatory Classification and Compliance

Understanding how your token is classified legally is fundamental. Tokens can be broadly categorized as utility tokens, security tokens, or a different type, each with its own regulatory implications.

Security tokens, for example, are subject to stringent securities regulations as they represent an investment and may be tied to the profitability of a project. Compliance with regulatory bodies like the Securities and Exchange Commission (SEC) in the U.S. or equivalent authorities in other jurisdictions is crucial.

Notably, the legal landscape for crypto tokens varies significantly across different jurisdictions. It’s vital to be well-versed with the laws in the regions where you plan to issue and trade your token. For global availability, this may require navigating and complying with a complex web of international regulations.

Given the complexities of blockchain and crypto regulation, which are continuously evolving, seeking advice from legal experts who specialize in blockchain technology is highly recommended. These professionals can guide you through the nuances of compliance, intellectual property rights, and more.

Smart Contract Review And Token Sales

Beyond technical audits for security and efficiency, a legal review of your smart contracts can ensure they meet regulatory requirements and avoid legal risks. This is particularly important for tokens with complex functionalities or those involved in financial transactions.

If raising funds through methods like Initial Coin Offerings (ICO), it’s important to understand the legal implications related to fundraising and securities laws. This includes how you advertise the sale, the information provided to potential investors, and the structure of the offering.

FAQ: How To Create A Crypto Token

How To Create A Crypto Token?

Creating a crypto token typically involves selecting a blockchain platform, defining the token’s purpose, writing and testing smart contracts, deploying the token on the blockchain, and planning for distribution and marketing. The process requires technical knowledge, particularly in blockchain technology and smart contract development.

How To Create A Token?

To create a token, start by defining its purpose and utility. Choose a blockchain platform that suits your needs, develop the token’s smart contract, test it thoroughly, and then deploy it on the chosen blockchain. Finally, focus on distribution strategies and marketing to build awareness.

How Much Does It Cost To Create A Crypto Token?

The cost varies based on factors like blockchain platform fees, development costs, legal and compliance expenses, marketing, and ongoing maintenance. Using no-code platforms can reduce costs, but custom development and ensuring legal compliance can be expensive.

How Much Does It Cost To Create A Token?

Creating a token can range from being relatively inexpensive using no-code platforms to quite costly if opting for custom development, especially when considering legal, marketing, and maintenance expenses.

How To Create A Crypto Token For Free?

You can create a crypto token for free by using testnets like Ethereum’s Ropsten for deployment, leveraging free development tools such as Remix IDE, and utilizing no-code token creation platforms. However, deploying on the mainnet and broader token management might incur costs.

How To Create A Cryptocurrency Token?

Creating a cryptocurrency token involves similar steps to any other crypto token: deciding on its purpose, choosing a blockchain, developing and testing the smart contract, and deploying it. Additionally, focus on ensuring the token’s liquidity and exchange listings.

How To Create A DeFi Token?

DeFi tokens require additional considerations like integrating complex financial functionalities, ensuring compatibility with DeFi protocols, and embedding governance mechanisms. They also require rigorous security measures due to their financial nature.

How To Create A Digital Token?

A digital token can be created by developing a smart contract that defines the token’s attributes and functionalities. It’s essential to choose the right blockchain platform and ensure the token’s utility aligns with its intended digital application.

How To Create A Meme Token?

Meme tokens are often created for their viral appeal and are heavily community-driven. They typically require basic smart contract functionalities and a strong focus on marketing and social media engagement to build a robust community.

How To Create A New Crypto Token?

To create a new crypto token, identify a unique purpose or utility that differentiates it from existing tokens. Follow the standard process of smart contract development, testing, and deployment, and ensure your token stands out through innovative features or use cases.

How To Create A New Token?

Creating a new token involves conceptualizing its unique selling point, developing the token on a suitable blockchain. Developers need to focus on aspects like security, legal compliance, and community building to ensure its successful adoption and use.

Featured image from Unsplash / Shubham Dhage

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

This news is republished from another source. You can check the original article here