The North American session was void of any key economic data although US employment trends did dip to 113.05 from 114.16. A new Fed survey of your head inflation dipped to 3.4% from 3.6% prior. Recall the Michigan consumer sentiment 1-year inflation expectation gauge fell to 3.1% from 4.5% in November on Friday.

Tomorrow the US CPI data will be released at 8:30 AM with expectations for the headline number to come in at 0.0% and for the core measure to come in at 0.3%. The CPI data comes before the FOMC rate decision on Wednesday at 2 PM ET. The Federal Reserve is expected to keep rates unchanged once again at 5.5%. The Fed has remained steady for two consecutive meetings after hiking one last time in July from 5.25% to 5.5%.

The Federal Reserve is one of four major central banks who will announce interest rate decisions this week. The Swiss National Bank, Bank of England, and ECB will all announce their interest rate decision on Thursday.

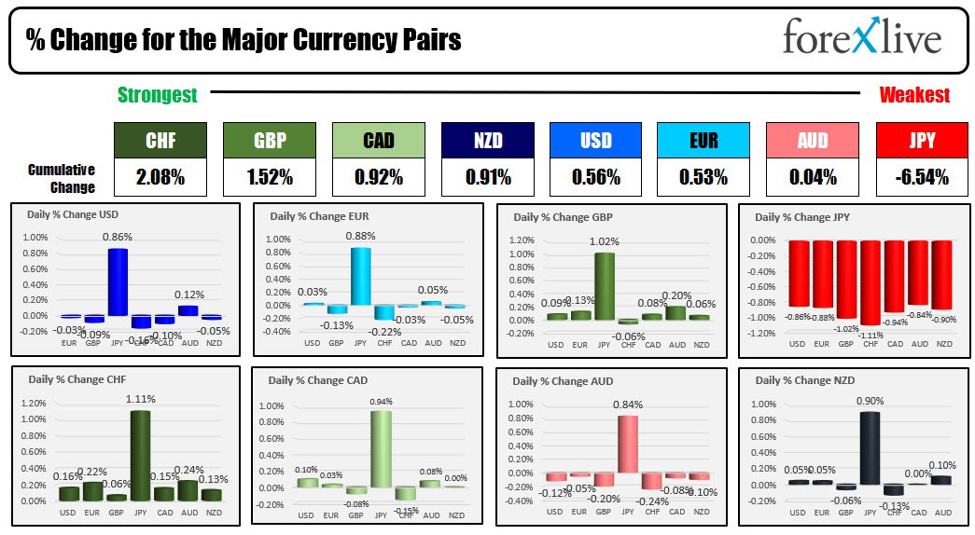

The JPY was the weakest while the CHF was the strongest

Today in the Forex market, the story revolved around the JPY. There was a report that laid to rest the idea that the Bank of Japan was on the verge of raising rates. That helped to push the JPY sharply lower versus all the major currencies. The biggest move was versus the CHF with a decline of -1.1%. The JPY lost -0.86% versus the USD, and -0.88% versus the EUR. It declined by -1.02% vs the GBP.

Apart from the 0.86% move against the JPY, the USD was little change vs the other major currencies. Its biggest move was a -0.16% decline vs the CHF. Versus the EUR, GBP, CAD and NZD, the greenback was within 0.10% of the closing levels on Friday. That is not a lot of price action. The US CPI data on one with the slew of central-bank decisions (and comments from central bankers) seems to be keeping the USD in check.

Looking at the US debt market today, yields were mixed despite some lukewarm treasury auctions in the three and 10 year maturity sector:

- 2- year 4.710%, -1.7 basis points

- 5-year 4.246%, -0.9 basis points

- 10-year 4.235%, -1.0 basis points

- 30-year 4.326% +0.1 basis points

Looking at the US stock market, the major indices all closed higher. The gains were led by rotation into the Dow stocks. Ironically, all of the so-called “Magnificent 7” fell on the day:

- Dow Industrial Average Rose 157.06 points or 0.43% at 36404.94

- S&P index rose 18.07 points or 0.39% at 4622.43

- Nasdaq index rose 28.52 points or 0.20% at 14432.50

Shares of Meta fell by -2.24% and Nvidia-1.85% leading the Magnificent 7 declines. Microsoft was the best performer with a decline of -0.78%.

Looking at the Dow 30, Intel led the way with a gain of 4.31%. Honeywell rose 2.97%, Nike rose 2.34%, Cisco rose 2.09% and Home Depot rose 1.49% rounding out the top five largest gainers. Verizon and Apple were the worst performers with declines of -1.50% and -1.29% respectively.

Crude oil prices today were steady. They are trading up nine cents on the day at $71.32.

Bitcoin fell sharply with the digital currency trading at $41,143. It traded as low as $40,181 before rebounding. Last Monday, the price surged above the $40,000 level for the first time since April 2022. Its high price extended to $44,729 on Friday of last week.

This news is republished from another source. You can check the original article here