Bitcoin has shattered records again, reaching a new all-time high of $97,903 just hours ago. The cryptocurrency market is exciting as Bitcoin leads the charge, delivering explosive gains that have fueled widespread bullish sentiment. Investors and traders alike speculate this rally is far from over, with Bitcoin edging closer to the monumental $100,000 mark.

Key data from Coinglass reveals another significant milestone: Bitcoin’s Open Interest has reached an all-time high. This surge in Open Interest indicates a flood of capital entering the market, signaling heightened activity and confidence among traders. Such metrics further confirm the euphoric state of the market, where optimism reigns supreme and momentum continues to build.

With Bitcoin’s price rallying at an unprecedented pace and market indicators hitting record levels, the stage is set for what many believe to be an almost inevitable breakout above the psychological $100,000 level. The market’s focus is whether BTC can sustain its trajectory or if a temporary pullback will precede the next leg up. Either way, the spotlight remains firmly on Bitcoin as it cements its status as the leading force in this explosive bull run.

Bitcoin Greed Enters The Market

Greed has gripped the Bitcoin market, with the average Fear and Greed Index hitting 76%, signaling heightened optimism among investors. This elevated level of greed suggests that market participants are buying aggressively, anticipating that Bitcoin’s price will continue its upward trajectory without significant setbacks. Such sentiment often leads to increased speculative behavior as traders look to capitalize on the ongoing rally.

Critical data from Coinglass supports this narrative, revealing that Bitcoin Open Interest—representing the total value of outstanding derivative contracts—has reached an all-time high of $62.69 billion.

This unprecedented figure highlights the speculative nature of the current market, as traders use leveraged instruments like futures to amplify their potential gains. While this fuels bullish momentum, it also adds volatility, making the market susceptible to sharp moves in either direction.

Interestingly, Bitcoin’s optimistic environment starkly contrasts the broader crypto market, where altcoins continue to struggle to reclaim yearly highs. While BTC leads the charge with record-breaking performance, altcoins have yet to catch up, underscoring Bitcoin’s dominance during this market cycle phase.

Related Reading

As speculative activity and investor optimism drive Bitcoin’s price action, the market waits to see if the rally has more fuel or if a correction looms. For now, Bitcoin remains the focal point of this euphoric bull run.

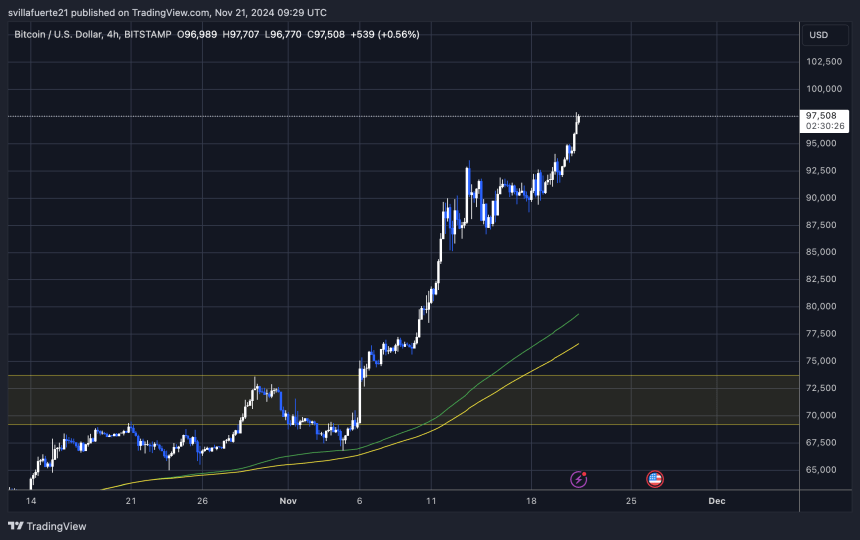

BTC Enters Price Discovery Again

Bitcoin is trading at $97,500 after setting a fresh all-time high, continuing its explosive rally. The market leader has entered price discovery—a phase often characterized by parabolic trends like the one currently driving BTC higher. Investor anticipation is growing, with the $100,000 mark only 2.5% away.

This psychological milestone could act as significant resistance, potentially holding Bitcoin down for an extended period. A consolidation phase around this level would benefit the broader market, allowing altcoins to catch up and the rally to maintain stability.

However, price discovery can be unpredictable. If Bitcoin fails to reach the $100,000 mark in the coming days, the market could see a pullback as bullish momentum cools. A retrace to lower demand zones, such as the $88,500 level, would provide the market with a necessary reset before the next leg upward.

Related Reading

Despite the possibility of a short-term correction, Bitcoin’s price action remains strong. Its dominance over the crypto market and the current euphoric sentiment suggest bulls are still firmly in control. As traders and investors closely monitor price movements, Bitcoin’s ability to push through key psychological levels will determine the next phase of this historic rally.

Featured image from Dall-E, chart from TradingView

This news is republished from another source. You can check the original article here