On-chain data shows the Bitcoin Hashrate has slumped back down recently as the cryptocurrency’s price has continued in a bearish trajectory.

Bitcoin Mining Hashrate Has Retraced Its August Recovery

The “Mining Hashrate” refers to a Bitcoin metric that keeps track of the total amount of computing power that the miners have currently connected to the BTC network.

When the value of this metric goes up, it means new miners are joining the blockchain and/or old ones are adding to their facilities. Such a trend implies that the network looks like an attractive venture to these chain validators.

On the other hand, the indicator registering a decline implies some of the miners have decided to disconnect from the chain, potentially because BTC mining is no longer profitable for them.

Now, here is a chart from Blockchain.com that shows how the 7-day average Bitcoin Mining Hashrate has changed over the past year:

Looks like the value of the metric has gone down in recent days | Source: Blockchain.com

As is visible in the above graph, the 7-day average Bitcoin Mining Hashrate had shown a rise in the middle of last month and had made recovery to levels not far from its all-time high (ATH) set back in July.

Towards the end of the month, however, the indicator had started going down instead and now, it has retreaded to almost the same lows as in the first-third of August.

The explanation behind these trends may lie in the fact that the miners depend on the BTC spot price for their profit margin. This is because the block subsidy, which they receive as compensation for solving blocks on the network, makes up for the primary part of their income.

These rewards are given out at a fixed BTC value and at a fixed time interval, so the only variable related to them is the USD price of the cryptocurrency. With the price struggling with bearish winds again recently, it makes sense that miners have been downsizing their operations.

As has historically been the case, though, this recent drop in the 7-day average Bitcoin Mining Hashrate may not stick for too long, with any fresh surges in the price likely to renew uptrend in the metric.

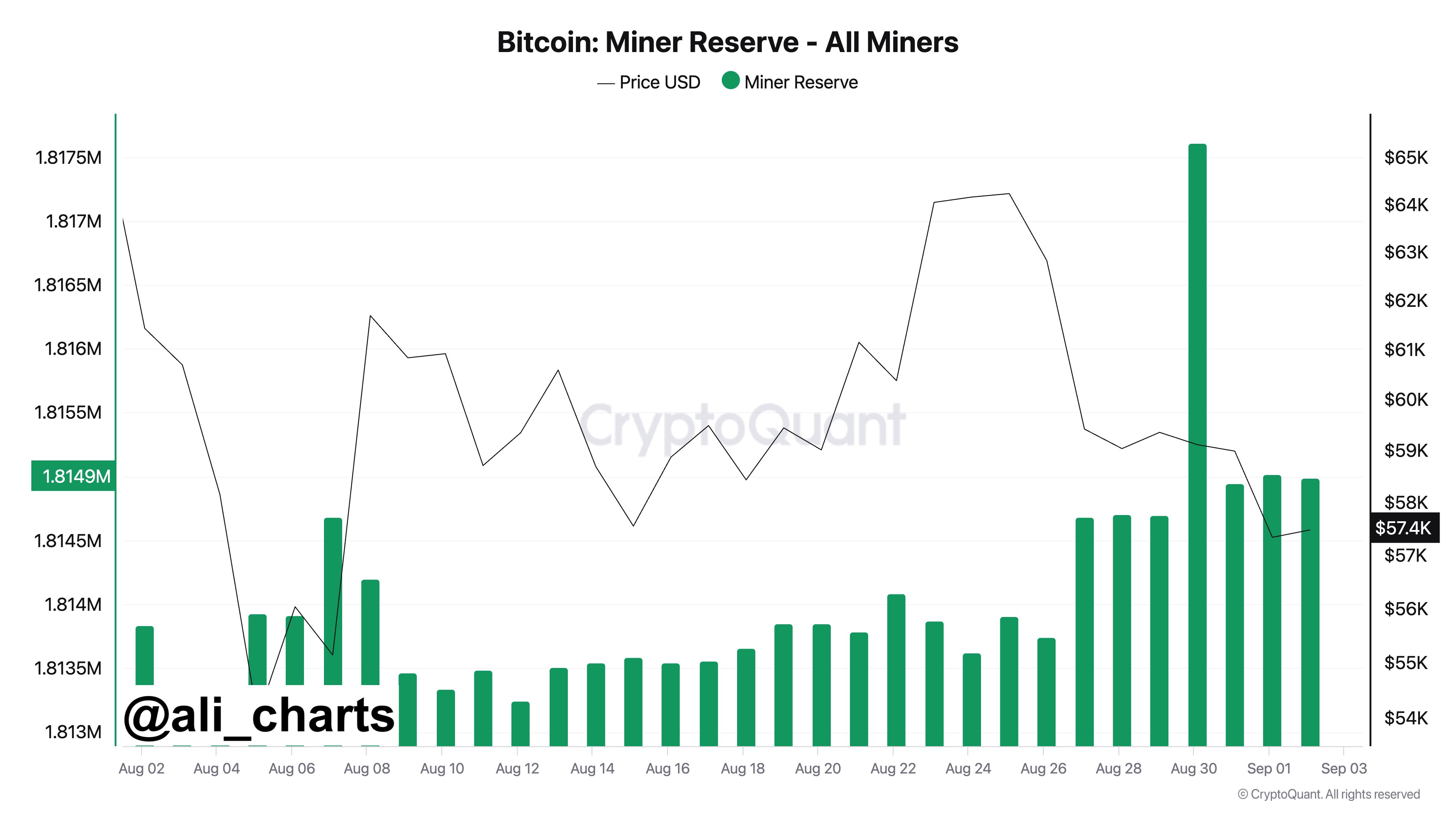

Besides the Hashrate, another indicator that could perhaps showcase miner distress is the Miner Reserve, which measures the total amount of Bitcoin that’s currently sitting in the wallets related to these chain validators.

As analyst Ali Martinez has pointed out in an X post, miners participated in a notable amount of selling over the weekend.

The trend in the BTC Miner Reserve over the past month | Source: @ali_charts on X

In total, the Bitcoin miners removed 2,655 BTC from their wallets during this window, which is worth more than $156 million at the current exchange rate of the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is floating around $59,000, down over 5% in the last seven days.

The price of the coin appears to have been moving sideways over the past few weeks | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, Blockchain.com, chart from TradingView.com

This news is republished from another source. You can check the original article here