Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

One of the most well-known institutional investors in Bitcoin is MicroStrategy. But even for seasoned investors, timing the market can be difficult, as seen by their most recent Bitcoin purchase, which is currently showing red.

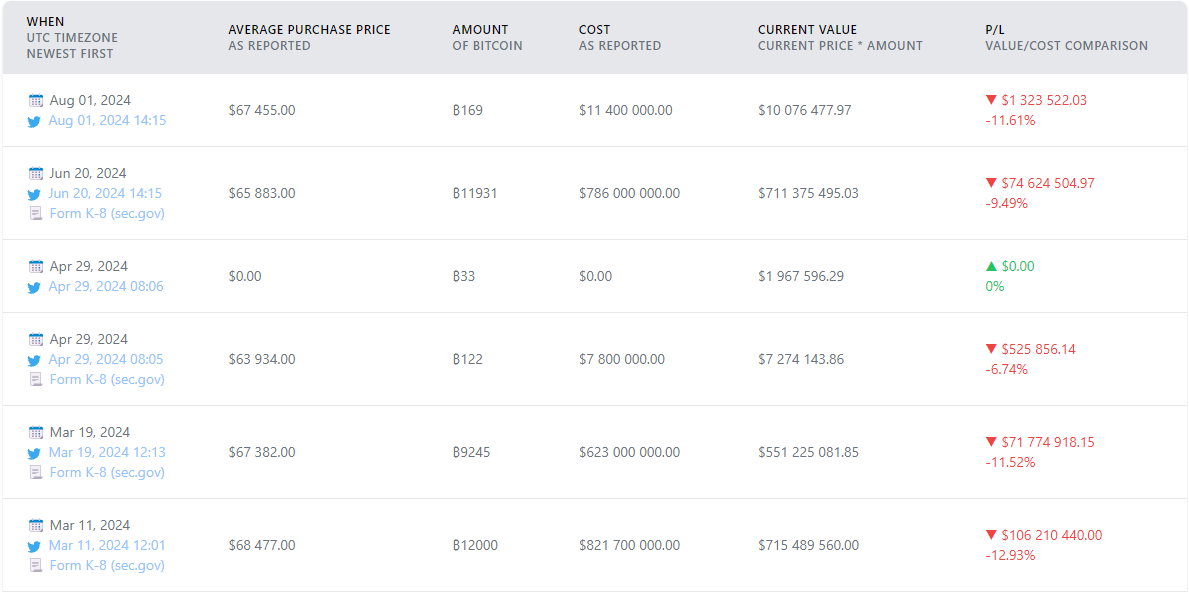

At present, MicroStrategy’s August 2024 acquisition of 8,169 Bitcoin at an average price of $67,455 per Bitcoin is indicating a loss of roughly $1.3 million, signifying an 11.61% decline in value. Given that MicroStrategy’s Bitcoin holdings have typically produced profits over the long run, this underperformance is noteworthy. With an all-time return of about 61.45% or $5.1 billion, the company has amassed a total of over 811,000 BTC.

Still, even for institutional investors with long-term investment horizons, the recent purchase underscores the volatility and risks involved with Bitcoin. The price of Bitcoin has been erratic lately. Bitcoin is currently trading at about $59,738 on the given chart, which is slightly less than the crucial $60,000 threshold.

As of March 2024, the asset has been in a descending channel, and it is currently hovering close to its lower boundary. A crucial level for long-term investors, the 200-day moving average is where price action suggests Bitcoin is having difficulty staying above.

This suggests a period of ambiguity on the market during which, contingent on market sentiment and outside variables like macroeconomic developments, Bitcoin may either attempt to recover higher levels or collapse below the descending channel.

The risks of accumulating Bitcoin at high levels are highlighted by the poor performance of MicroStrategy’s most recent Bitcoin acquisition. However, the business has a long-term plan and has made significant gains in the past. The recent decline is a minor setback that MicroStrategy should tolerate without any issues, thanks to its enormous liquidity.

This news is republished from another source. You can check the original article here