A rebound from the broader cryptocurrency market triggered a $170-billion recovery in valuation, spiking the market cap 8% to $2.26 trillion.

Here are some of the most notable movers to watch this week.

Solana reclaims $160

Last week, Solana (SOL) surged 12%, reclaiming the $160 level and peaking at a two-week high of $162 on Aug. 24 despite setbacks in its ETF product. After closing the week strong, SOL has now pulled back to $157.17.

However, Solana remains above the 200-day EMA at $140.12, signaling ongoing bullish momentum. This week, SOL needs to hold above the 200-day EMA to sustain the ongoing upward trend.

Meanwhile, the Chande Kroll Stop indicators place the Stop Long at $145.22 and the Stop Short at $153.18. Maintaining above $153.18 is key for further gains, as a breach could lead to a bearish reversal.

This week, investors should watch for a retest of the $160 and $162 resistance zones or a decline toward key support at $153.18.

FET spikes 50%

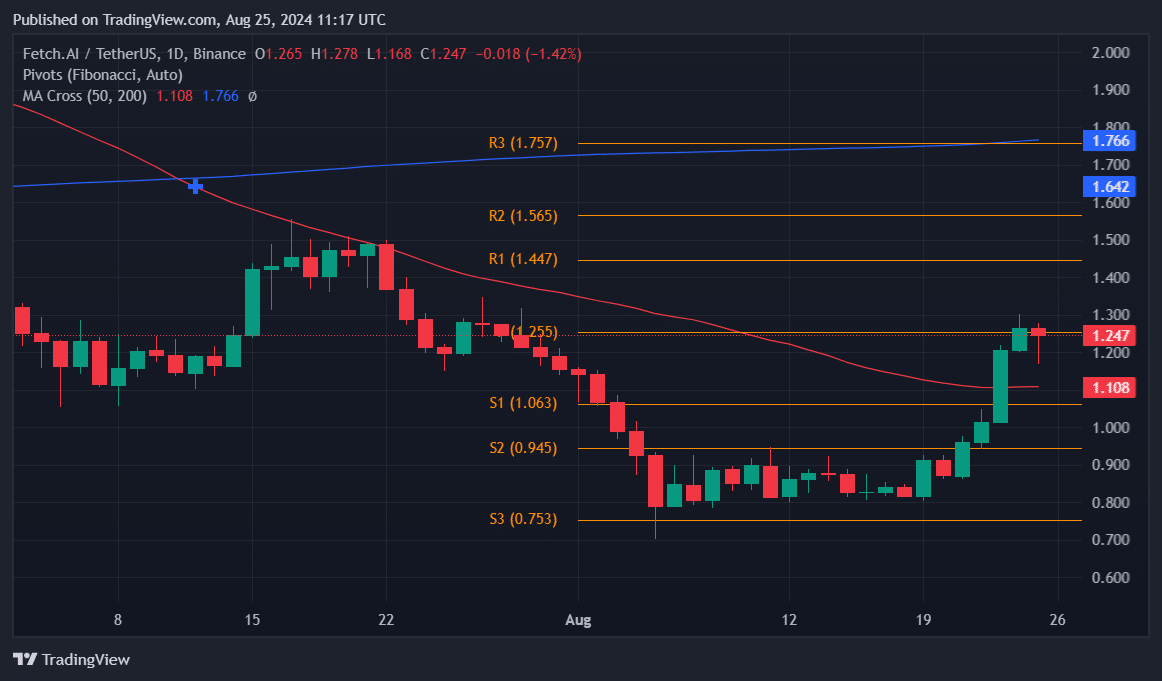

Fetch.ai (FET) closed last week as one of the top gainers, spiking 50% and reclaiming the $1 level. On Aug. 24, FET reached a monthly peak of $1.3 but has since retraced to $1.249.

FET currently trades above the 50-day EMA ($1.108), signaling midterm bullish momentum. However, it remains below the 200-day EMA ($1.766), indicating lingering long-term bearish sentiment.

FET’s immediate resistance points this week are at $1.447 and $1.565, with strong support at $1.063 and $0.945, with a pivot level of $1.255. A break above the resistance could target the 200-day EMA, while failing to hold support would lead to a drop below the 50-day EMA.

RENDER breaches upper Bollinger Band

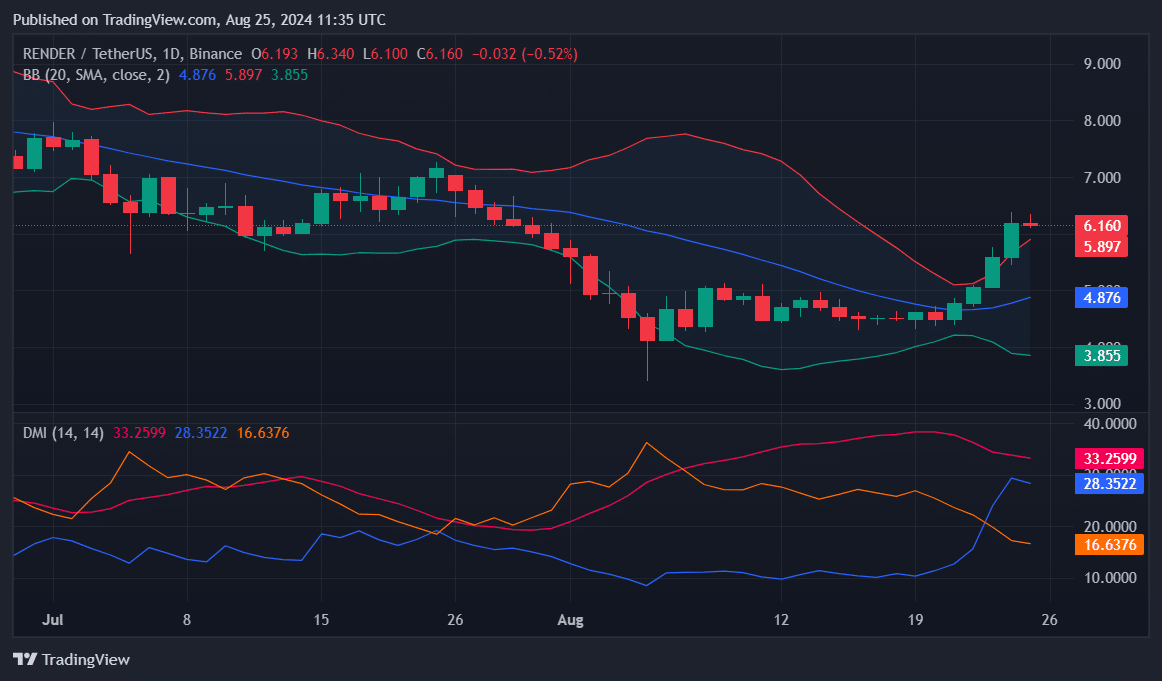

Render (RENDER) saw a 37% rise last week, reclaiming the $6 level for the first time this month.

Currently trading at $6.153, RENDER is comfortably above the Upper Bollinger Band ($5.894), which often signals overbought conditions. This suggests a potential pullback or consolidation might be on the horizon.

However, the strong trend indicated by the ADX at 33.25 supports the idea of sustained upward momentum. The asset maintains a bullish bias with the +DI at 28.35 and -DI at 16.63.

If the current momentum holds this week, Render could aim for higher targets around $6.5 and potentially $7.0.

Nonetheless, a dip below the Upper Band might lead to a retest of the 21-day moving average ($4.875).

This news is republished from another source. You can check the original article here