- Brazil approves second Solana ETF provided by Hashdex.

- Despite Solana ETf approval Sol struggles as ETFs uncertainty rock US market.

Brazil became the first country to approve Solana [SOL] exchange-traded funds two weeks ago. As reported earlier by AMBCrypto, Brazil has cemented its position as one of the most pro-crypto governments in the world.

While other countries such as Canada and the U.S. have received filings for Sol ETFs, they lag in approval. Another milestone was that the South American nation approved the second Solana-based ETF.

Brazil approves second SOL ETF

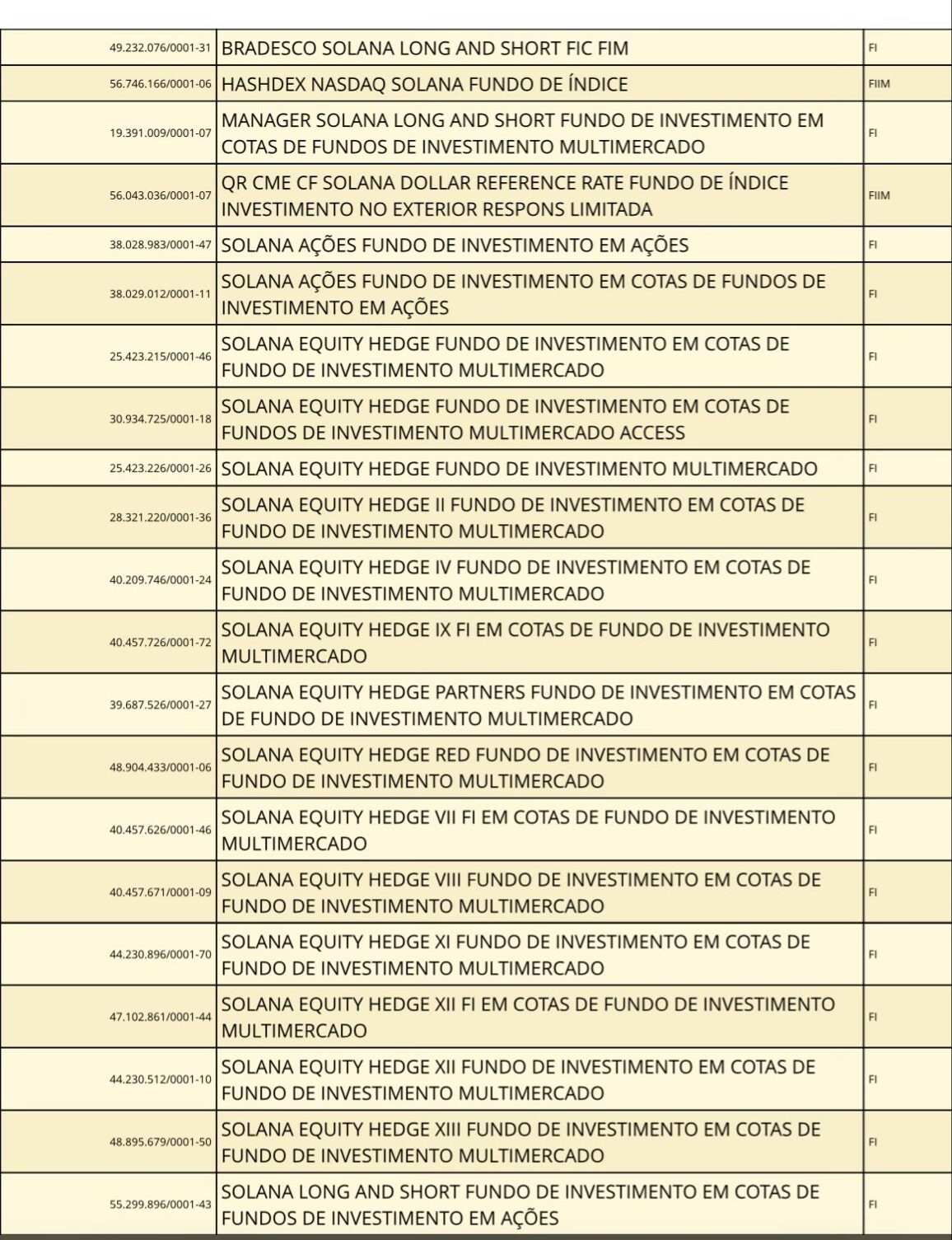

The Brazilian Securities and Exchange Commission (CMV) has approved a second Solana exchange-traded fund (ETF).

According to the agency’s database, the new ETF is operational and will be offered by Hashdex. The provider (Hashdex) is a Brazil-based asset manager with $963 million in assets under management.

In providing the new ETF, the asset manager will work with BTG Pactual, a Brazilian bank. Therefore, Hashdex, having managed the Nasdaq Crypto Index, is well prepared for the Sol ETF challenge.

SOL struggles for traction

Despite the Brazilian move to approve 2 Solana ETFs and growth in the network, SOL is stagnant. SOL continues to struggle in price charts and continues to underperform.

One factor resulting in sol struggles is the decline in memecoin frenzy. Solana-based meme coins have faded in the hype, thus reducing its network adoption.

This mainly results from stiff competition from the Tron network, which has seen a massive memecoin frenzy.

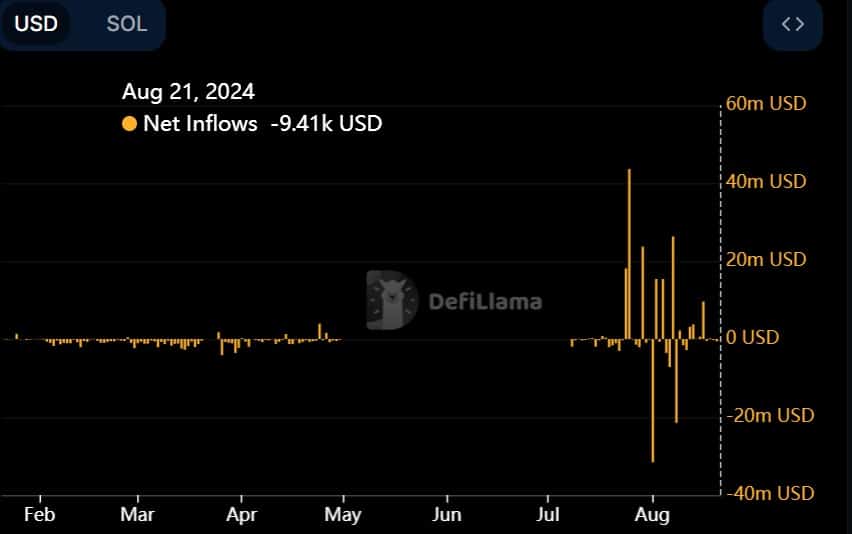

Additionally, the decline in network activity such as Defi, NFTs, and gaming resulted in low inflow as investors’ confidence declined. This has impacted inflow, with the network reporting more outflows than inflow with a negative net flow of -9.4K.

Therefore, SOL continues to decline on price charts by 2.5% and trades at $143.57, as of this writing.

ETFs uncertain in the USA

While Brazil is making moves towards more Solana ETFs, the U.S. market is in jeopardy. According to the report, the filing of Sol ETFs in the U.S. did not move to behold the second phase.

The Securities and Exchange Commission failed to acknowledge the failing of Sol ETFs. Eric Balchunas argues that SOL ETFs have failed over SEC’s indifference, and the situation will remain until 2025 if Trump wins. Through his X page, he noted that,

“Solana ETF filings never made it past Step 2 (the SEC failed to ack them) = DOA. So, the exchanges withdrew 19b-4s although the issuers’ S-1s are still active. A snowball’s chance in hell of approval unless there’s the change in leadership.”

Based on recent reports, Solana ETF filings disappeared from the Cboe website.

In June, VanEck and 21Shares filed for Solana ETFs; thus, the removal of their fillings created more doubt. These disappearances come amidst increased debate by SEC that Solana is a security.

This news is republished from another source. You can check the original article here