The global cryptocurrency market is worth $2.4 trillion. Top performers Bitcoin and Ethereum have delivered gains of 100% and 68% over the last 12 months, as easing inflation has brought less stable investments back into fashion. However, cryptocurrencies remain a riskier play than most stocks, as they are known for their volatility and prices that can rise and fall on the whim of something as simple as a social media post.

Crypto’s decentralized nature makes it easy to use, enabling worldwide transactions with minimal fees. However, it can also mean that without tangible ties to an organization, there can be very little rhyme or reason for price fluctuation.

As a result, investors looking to grow their portfolio with less risk might want to consider tech stocks. Tech is an ever-expanding market that benefits from consistent demand for upgraded software and hardware products. Consequently, investing in companies with solid business models and market penetration can deliver major growth over the long term.

So, here are two tech stocks with more potential than any cryptocurrency.

1. Intel

You might be surprised to see Intel (NASDAQ: INTC) on this list, with its stock down 39% since 2021. The company doesn’t exactly have a reputation for outperforming cryptocurrencies. However, Intel is turning things around and is active in industries that could help it see its stock price soar in the coming years.

Intel shares jumped 13% in the last month as investors appear to be taking notice of recent restructuring. In 2023, the company announced a “fundamental change” in its operations that would see it expand full force into the foundry market by building chip fabs across North America.

According to Allied Market Research, the semiconductor foundry market was estimated at $107 billion in 2022 and is projected to more than double to $232 billion by 2032. Chip demand skyrocketed in recent years as advances in various tech sectors require more powerful hardware to take their designs to the next level.

Since the start of 2023, artificial intelligence (AI) has become a critical growth driver for chip sales, with graphics processing units (GPUs) needed to develop the generative software. As a result, Intel has set its sights on becoming a leading AI chip fabricator, allowing it to profit from increased demand across the industry. Considering chip giants like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices outsource much of their manufacturing, Intel is positioning itself to be the go-to U.S. chip fabricator.

The AI market is expanding at a compound annual growth rate of about 37%, on its way to hitting nearly $2 trillion in spending by 2030. Chip demand is only likely to keep rising in that time, suggesting Intel is nowhere near hitting its ceiling.

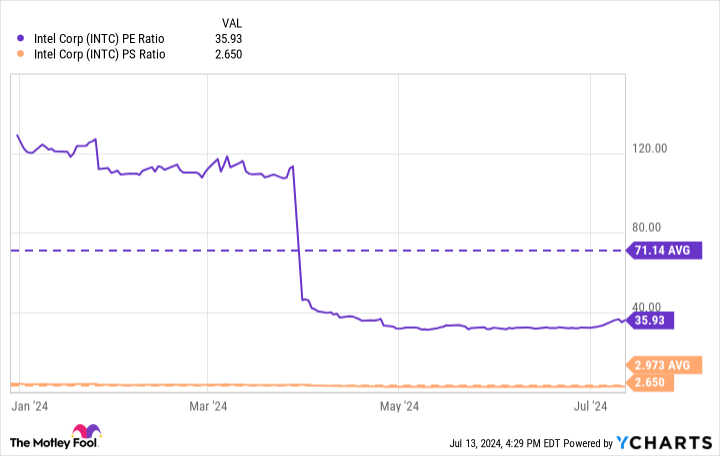

Moreover, two key metrics indicate Intel is trading at a value, which could also attract new investors. The company’s price-to-earnings ratio and price-to-sales ratio are below their 12-month averages. The company is investing heavily in some of the world’s most lucrative industries, which could allow its stock to outperform the crypto market over the next decade.

2. Nvidia

Nvidia’s stock has grown faster than Bitcoin and Ethereum for at least five years. Meanwhile, the company’s potent position in tech suggests it will likely keep beating the crypto market long into the future.

Prior to 2023, Nvidia was most known for its dominant position in gaming. The chipmaker is responsible for 88% of the discrete desktop GPU market, which has grown from 65% over the last 10 years. The company’s chips have become the preferred option for gamers worldwide, who use the GPUs to build high-powered gaming computers.

Nvidia’s success in the market allowed it to branch out to multiple other tech areas, from handheld game consoles to laptops, cloud platforms, and, most crucially, AI. The tech giant has reinvented itself as one of the biggest threats in artificial intelligence, as its AI GPUs have become the gold standard. Nvidia now boasts a lucrative list of prominent clientele, with Microsoft, ChatGPT developer OpenAI, and Alphabet‘s Google Cloud all using its chips.

Nvidia’s success in AI has seen its quarterly revenue and operating income soar by 93% and 149% over the last year. Meanwhile, its free cash flow climbed 281% to $39 billion. Comparatively, Nvidia’s rival AMD’s free cash flow hit just over $1 billion this year. So, in addition to its dominant market share, Nvidia is more financially equipped to keep investing in its technology and extend its lead in AI.

Nvidia’s massive growth potential means that even with a forward price-to-earnings ratio of 47, its stock is a buy and a better option than any cryptocurrency.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Bitcoin, Ethereum, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Tech Stocks With More Potential Than Any Cryptocurrency was originally published by The Motley Fool

This news is republished from another source. You can check the original article here