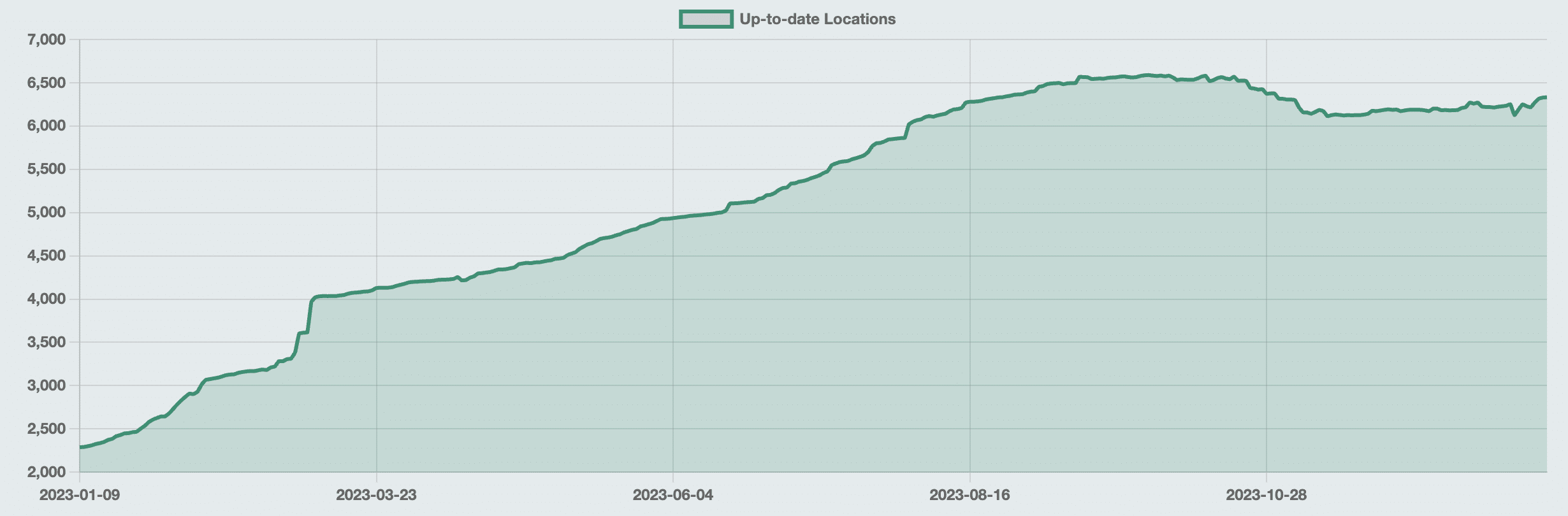

The landscape of cryptocurrency usage is rapidly changing, with over 6,000 in-person vendors across the globe now accepting Bitcoin.

According to BTC Map, the up-to-date number of merchants accepting Bitcoin holds steadily above 6,000, currently at 6,332 as of Jan. 8. In the past year, the active location count has tripled from the 2,000 level in January 2023.

The statistics demonstrated that there are 5,535 businesses accepting on-chain transactions, 5,107 merchants accepting Lightning payments, and 1,050 vendors supporting contactless.

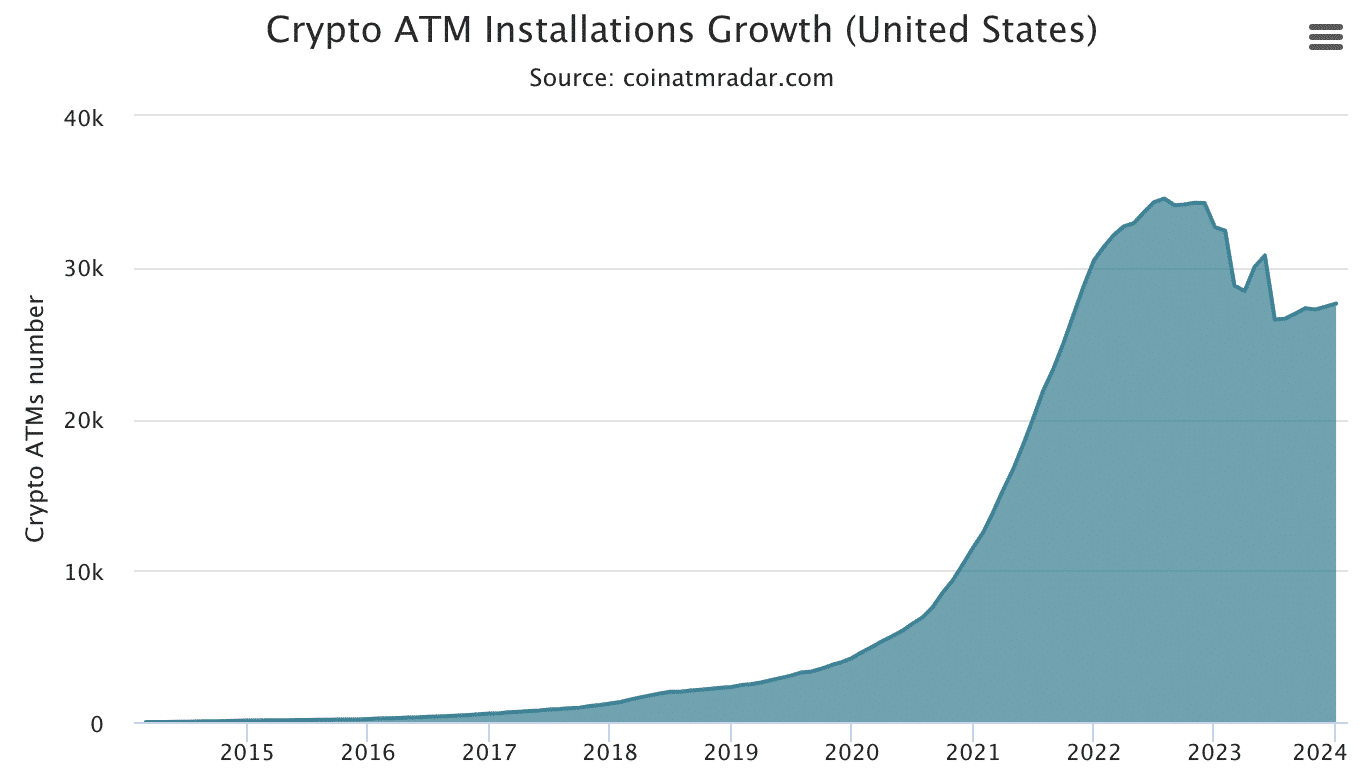

Bitcoin ATMs Witness First Global Decline in a Decade

While the number of in-person vendors accepting Bitcoin has soared, there’s been a contrasting trend in the world of crypto ATMs. For the first time in a decade, 2023 saw a decrease in the number of crypto ATMs globally.

According to Coin ATM Radar, the total count dropped by 11%, from 37,827 at the start of 2023 to 33,622 at the beginning of 2024.

This decline was particularly evident in the United States, home to 82% of the world’s crypto ATMs. Over the course of 2023, the U.S. saw its number of crypto ATMs fall from 32,672 to 27,621.

However, the scenario was different in certain regions. The European Union witnessed a slight increase, with the number of crypto ATMs rising from 1,538 to 1,548. Similarly, countries like Canada, Australia, Spain, and Poland also saw an uptick in crypto ATM installations.

Spot ETFs Awaiting SEC’s Final Decision

In addition to the increasing number of physical stores and ATMs, the U.S. Securities and Exchange Commission’s pending decision of spot Bitcoin exchange-traded funds (ETFs) further signifies the traditional finance’s gradual embrace of crypto.

The anticipation within the crypto community is palpable as the SEC nears its deadline of Jan. 10 to rule on several applications for spot Bitcoin ETFs. The anticipated approval will set a precedent for how digital assets are perceived and traded within the finance industry.

For a spot Bitcoin ETF to begin trading, the SEC needs to first sanction the 19b-4 filings by exchanges intending to list these ETFs, followed by the approval of S-1 registration applications from the issuers.

Should the SEC approve both requisites, these ETFs could potentially start trading the very next business day, which could be as early as Jan. 11.

This news is republished from another source. You can check the original article here